88% surveyed plan to use tax-aware long/short

More than half said they plan to use it for the long-run

Tax alpha bulletin board…

🎉 Basis Northwest is my taxable wealth conference. It’s in Seattle in 2026.

🔬 Call for papers… Nathan Sosner, a principal at AQR, is Special Section Editor for the Journal of Wealth Management’s Fall 2026 issue. Submit a paper by Feb 1, 2026.

88% surveyed plan to use tax-aware long/short

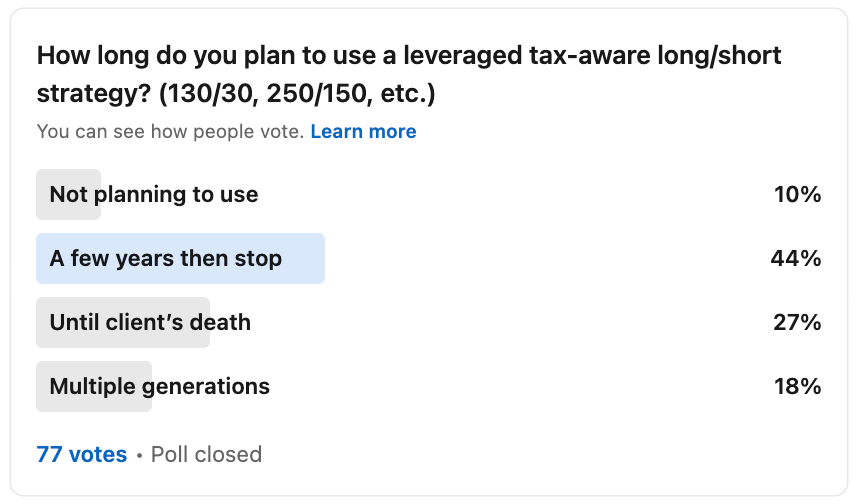

I ran a survey last week asking, “How long do you plan to use a leveraged tax-aware long/short strategy? (130/30, 250/150, etc.)”

162 people responded across LinkedIn, Substack, and Twitter.

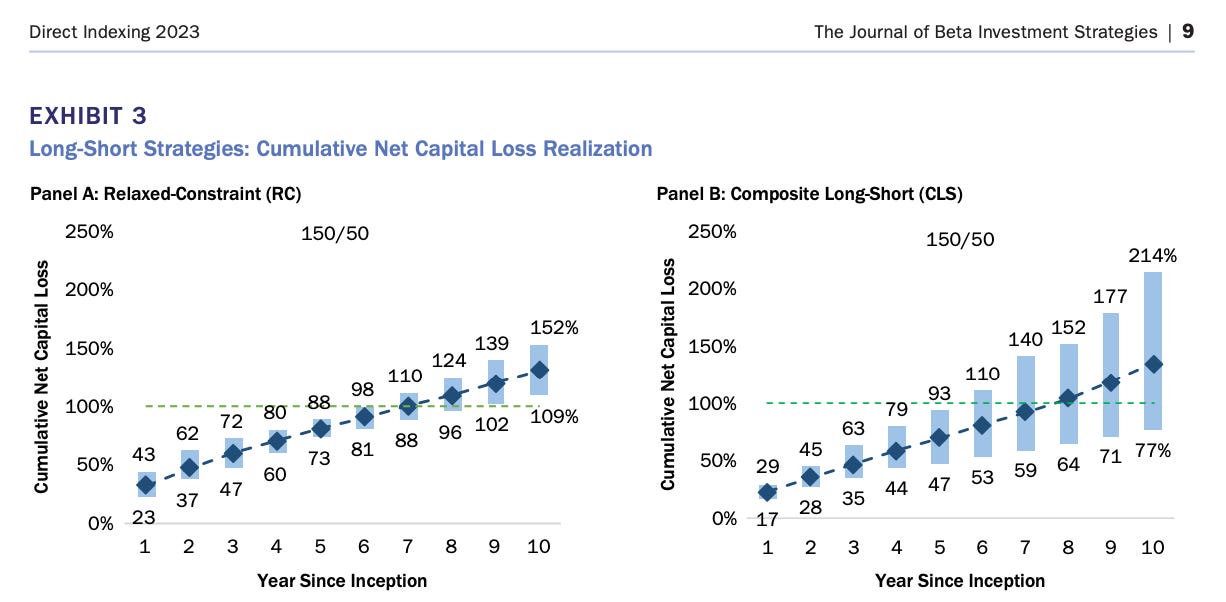

Here’s a two-sentence, two-image refresher on tax-aware long/short and an example of backtested capital losses from AQR (please read the paper, it’s a good one!, for backtest details).

First, this is a ridiculous question to ask on social media, since tax-aware long/short is very niche, and everyone and (literally) their mother hangs out there.

So, I report the broad results (162 respondents) and wealth industry professionals (73 respondents), which I manually confirmed.

Without spoiling the result, insiders and wealth managers should pay attention to how their colleagues view tax-aware long/short.

Wealth managers should go beyond the immediate alpha and capital losses and have a crisp plan for managing leverage over time, including across generations (if that’s the best way to help their clients achieve their goals).

These are very interesting topics to me, so if you’d like to share how you manage these concerns, send me a note. I’d like to hear from you!

Here’s what the survey revealed.