Absurd reasons investors don't sell concentrated positions: "I'm holding strong"

Lessons from Baird Wealth Management and Reddit

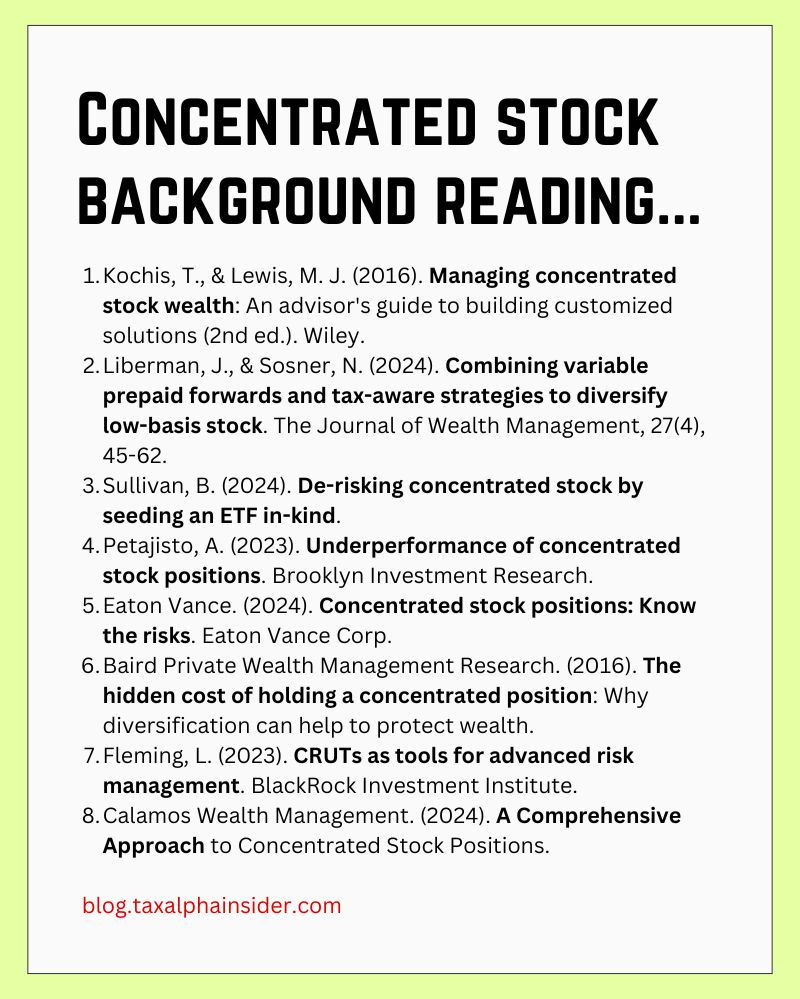

The Baird paper mentioned in the graphic above includes several reasons investors hold concentrated positions. But it missed a few good ones I’ve heard over the years.

So, I went to Reddit to fill in the gaps.

Why investors hold:

FOMO: Tres commas

Tax: Afraid to rip off the Band-Aid

Past stock success: Number go up

Overconfidence in predicting the future: “I…