Advisers consider all options as Fidelity extends pause on new tax-aware long/short account openings

Advisers consider diversifying custody exposure

This article is educational content, not investment, tax, or legal advice. Hire an adviser or tax attorney for personalized guidance.

Reporting note: This post is based on conversations with more than a dozen advisers and industry participants. Fidelity declined to comment. Where noted, comments reflect adviser opinions or unverified rumor. If Fidelity provides clarification, I will update this post.

Two-day taxable wealth conference

Seattle, WA - Late May 2026

Advisers consider all options as Fidelity extends pause on new tax-aware long/short account openings

On Thursday, Jan 8, 2026, I heard through the grapevine that Fidelity had extended the previously reported pause on new account openings for tax-aware long/short strategies.

Tax-aware long/short strategies (e.g., 130/30, 250/150, etc., “TALS,” for simplicity), customized in separate accounts, are white-hot in taxable wealth nowadays. Here’s a recent refresher for anyone getting up to speed.

A source confirmed that new account openings would resume in “late February” (though one adviser suggested mid-February) and that the nature of the pause was “related to growth” (another said “exuberant growth”) and that Fidelity was “considering updates to governance.”

Rumor is Fido is going to lockdown l/s accounts to select firms

Adviser, Jan 2026

I heard this from multiple advisers.

Another adviser added color to the “governance” comment.

I was told that “governance” boils down to needing to build out risk process to consider the growing short book. I have also heard (from a provider, not Fidelity) that a decent amount of the growth at Fidelity has been new L/S accounts opened by RIAs who do almost all other business with Schwab, a dynamic which is also causing Fidelity to call “time out” to assess if it is good business.

IMO Fidelity operates on the conservative end of the spectrum, and benefits from being privately held. I was assured that the pause is NOT because of a problem, more preventive in nature. It will be interesting to review SCHW quarterly results for any L/S commentary.

Adviser, Jan 2026

This is not the first news of a pause on new TALS account openings.

I wrote about this last month, when the pause was first announced.

Advisers report Fidelity pauses new tax-aware long/short accounts until mid-Jan 2026

This article is educational content, not investment, tax, or legal advice. Hire an adviser or tax attorney for personalized guidance.

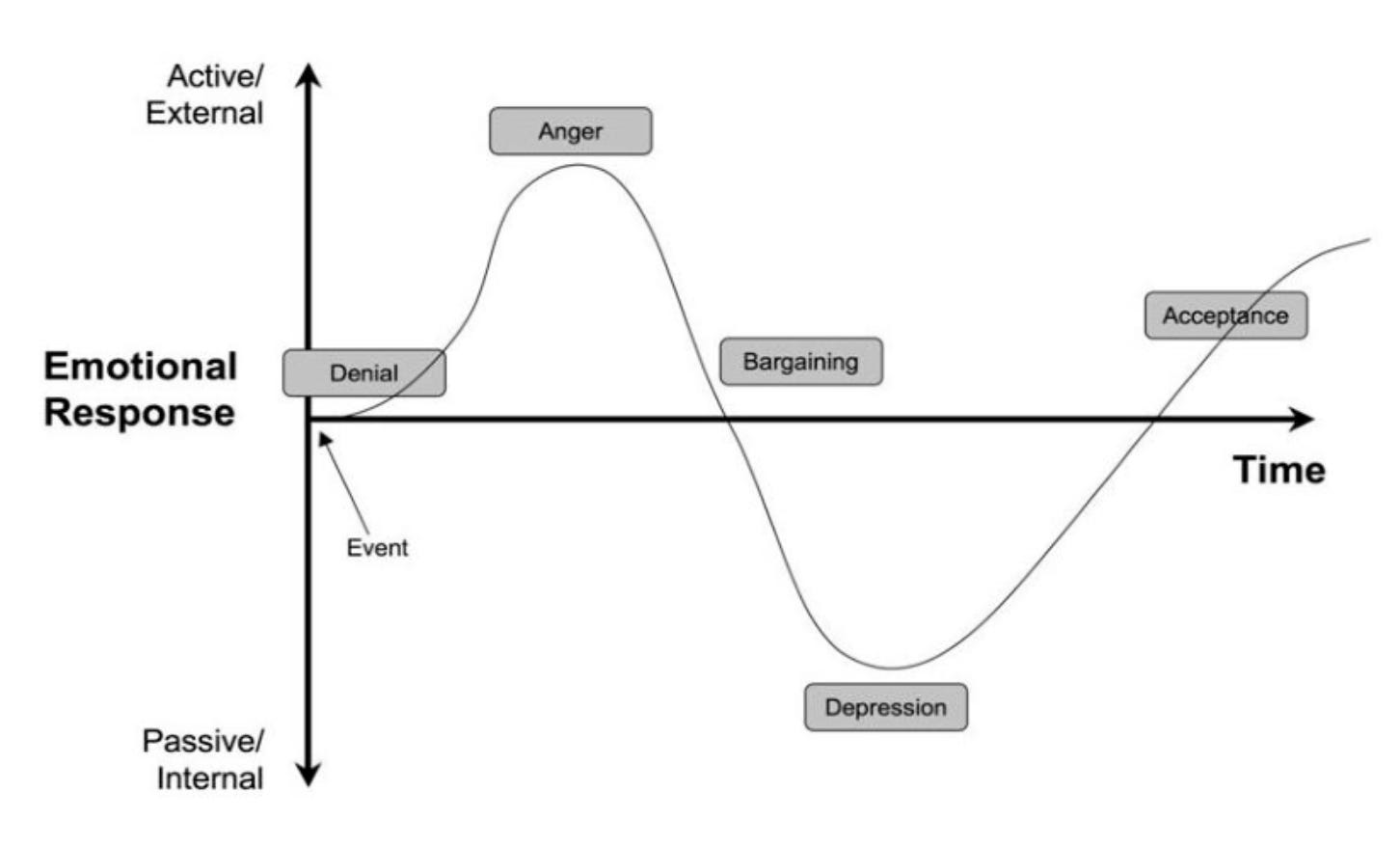

Many advisers see TALS as a critical differentiator and planning tool. They communicated the full range of emotions when speaking off the record with me.

While my article captured the frustration many advisers felt at the time, the comments kept rolling in after I hit publish.