An exchange fund will seed an ETF in-kind... again

Getting the band back together

Tax alpha bulletin board…

🎉 Basis Northwest is my taxable wealth conference. It’s in Seattle in 2026.

🔬 Call for papers… Nathan Sosner, a principal at AQR, is Special Section Editor for the Journal of Wealth Management’s Fall 2026 issue. Submit a paper by Feb 1, 2026.

📗 The Adviser’s Guide to Seeding an ETF In-Kind (via Section §351)

📢 Not Advice Podcast Live: Andre Nader and I are back for another live recording of the Not Advice pod on Tuesday. Join us on Substack (you’ll receive a reminder email if you subscribe to either of us), or on LinkedIn live, or on my twitter.

Disclaimer: This is educational content. It is not investment, tax, or legal advice. It is not an endorsement of any product, strategy, or vendor. Consult an adviser about your particular circumstances, the partnership in question, and the conditions, risks, and tradeoffs of participating.

Back in May, I wrote about Cache, the VC-backed startup that’s modernizing exchange funds, using portfolio assets to seed an Alpha Architect ETF, AAUS, in-kind.

Well… they’re about to do it again with a new Alpha Architect ETF, AAEQ.

Before jumping in, I’m grateful to Srikanth and Christopher from Cache for pulling out all the stops to answer my questions.

Here’s how this article flows:

I’m going to do everyone a favor and keep the background reading brief. My previous article goes deep, so I would start there if you want the basics.

Then, I’m going to address how everything has gone since the July 2025 in-kind seed. ETFs are transparent, and so is Cache, so this will be easy.

I’ll address a reader question about how Cache enables liquidity for contributed shares before the seven-year disguised sale/anti-mixing bowl rules expire.

Curious investors should ping the managers right away:

Nov 17-26 2025: Alpha Architect for details on directly contributing to AAEQ

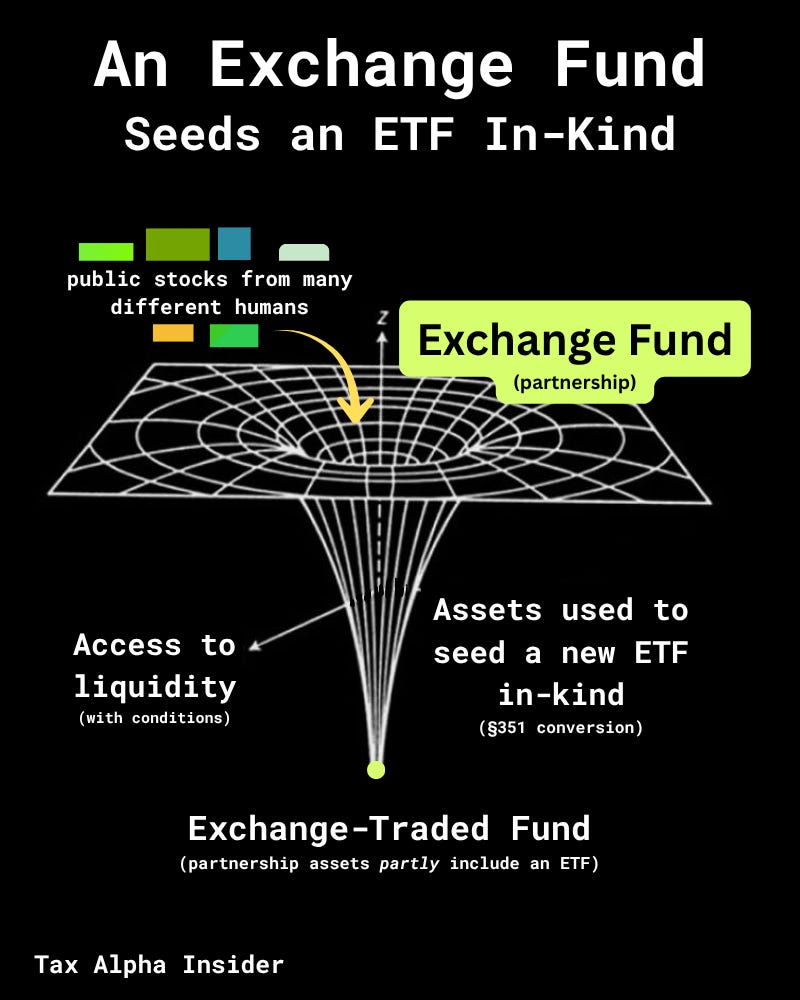

To kick things off, here’s an artist’s interpretation of how the exchange-fund-to-ETF assets will flow.