Box spreads are "effectively free of credit risk"...I guess?

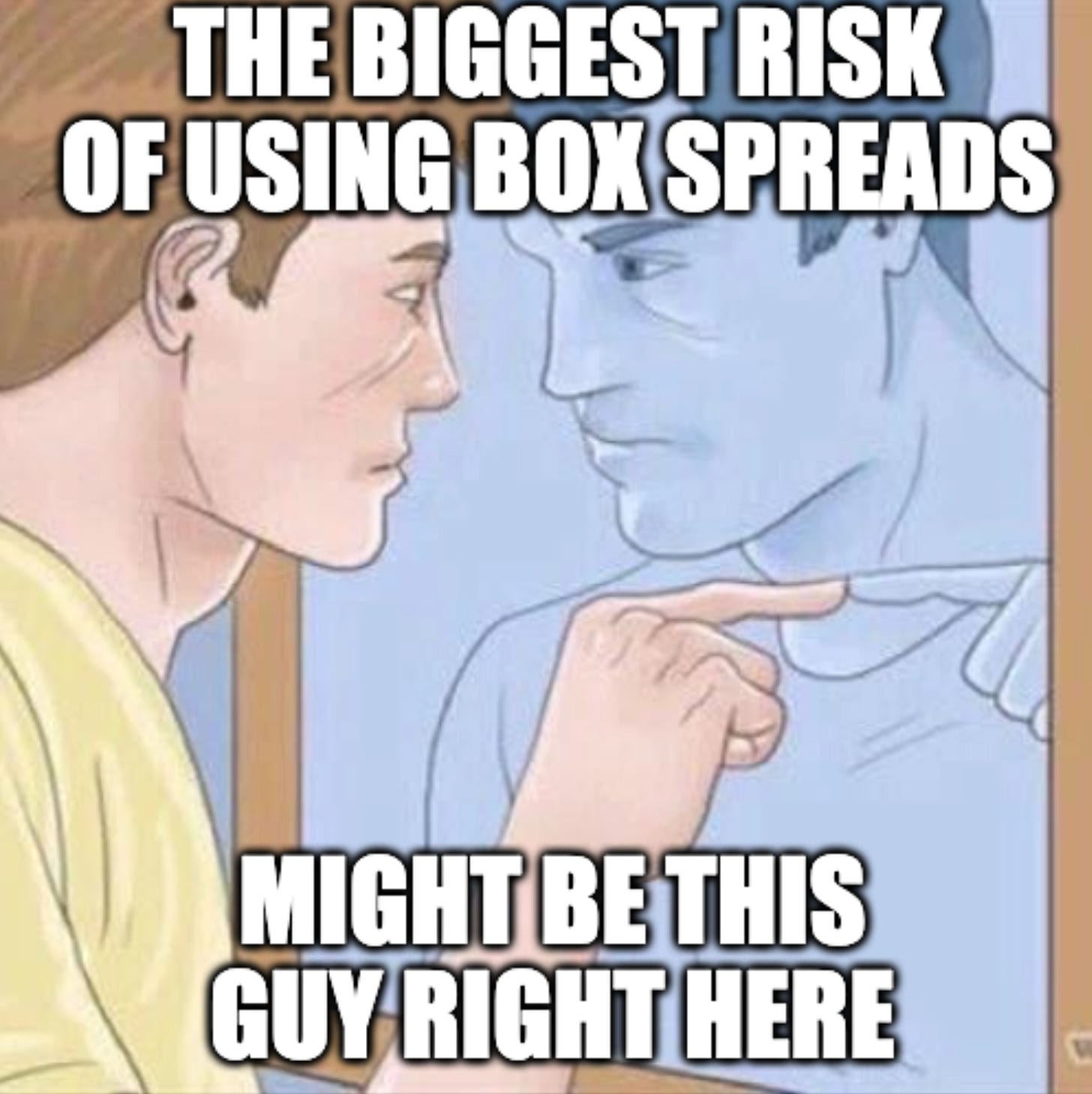

The biggest risk to borrowing via box spread may be the borrower

Before box spread risk… the latest episode of the Not Advice pod called “De-Risking Chonky Stock Positions with Tax-Loss Harvesting, Exchange Funds, CRUTs, and Section 351 Conversion” is here…

My article, Better borrowing via box spread? Why it's worth grokking the box has netted me 50+ new subscribers and 3k views in about 24 hours. I don’t know why.

Box spreads are obscure. However, many people seem intrigued by the possibility of decentralized borrowing and lending, as well as the better borrowing rates and tax efficiency of all the sizzling new products built on top of them.

As a quick recap, box-spread-powered ETFs (like BOXX at ~$8B), synthetic lending solutions, and newer things like a listed variable prepaid forward, and a tax-aware long/short portfolio funded by a box, are creeping into investor/adviser consciousness.

“It’s a real unlock,” said someone who’s selling one of these products, of course.

I mostly agree…

But that’s the reward… what about risk?

I started asking harder questions of the vendors building things on top of the box spread, and here’s what a few of them came back with…