Concentration risk and volatility drag

What happens when someone answers "20" for their 1-10 risk tolerance?

The Diamondbacks will be in Seattle on May 29, just down the road from Basis Northwest. We might have to go to the game right after the conference.

“How did you go bankrupt?” Two ways. Gradually, then suddenly.”

- Ernest Hemingway, The Sun Also Rises

Concentration risk and volatility drag

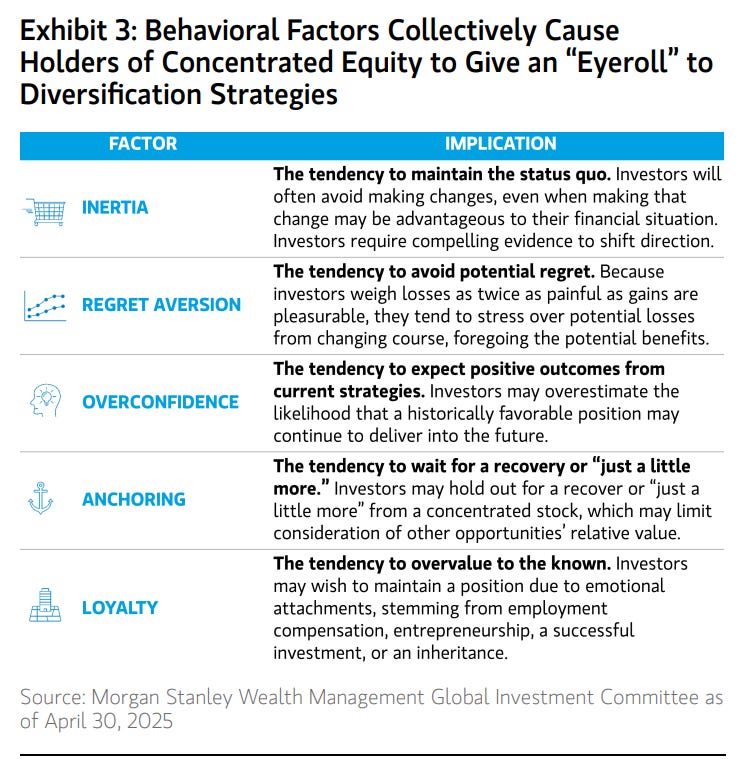

I recently wrote about the Eyeroll table from Morgan Stanley. It explains why some investors continue holding massively concentrated positions even though the risk is mostly uncompensated.

In that piece, I argued that some folks were swinging for the fences and telling them to diversify probably wouldn’t work.

Some friends agreed…

For the sort of investor who answers “20” when you ask their risk tolerance on a scale of 1-10, I started wondering what an appropriately compensated pedal-to-the-metal portfolio would look like.

Andy Cole, a financial advisor with Fiduciary Financial Advisors, had posted some relevant content around that concept, and I ran this idea by him.

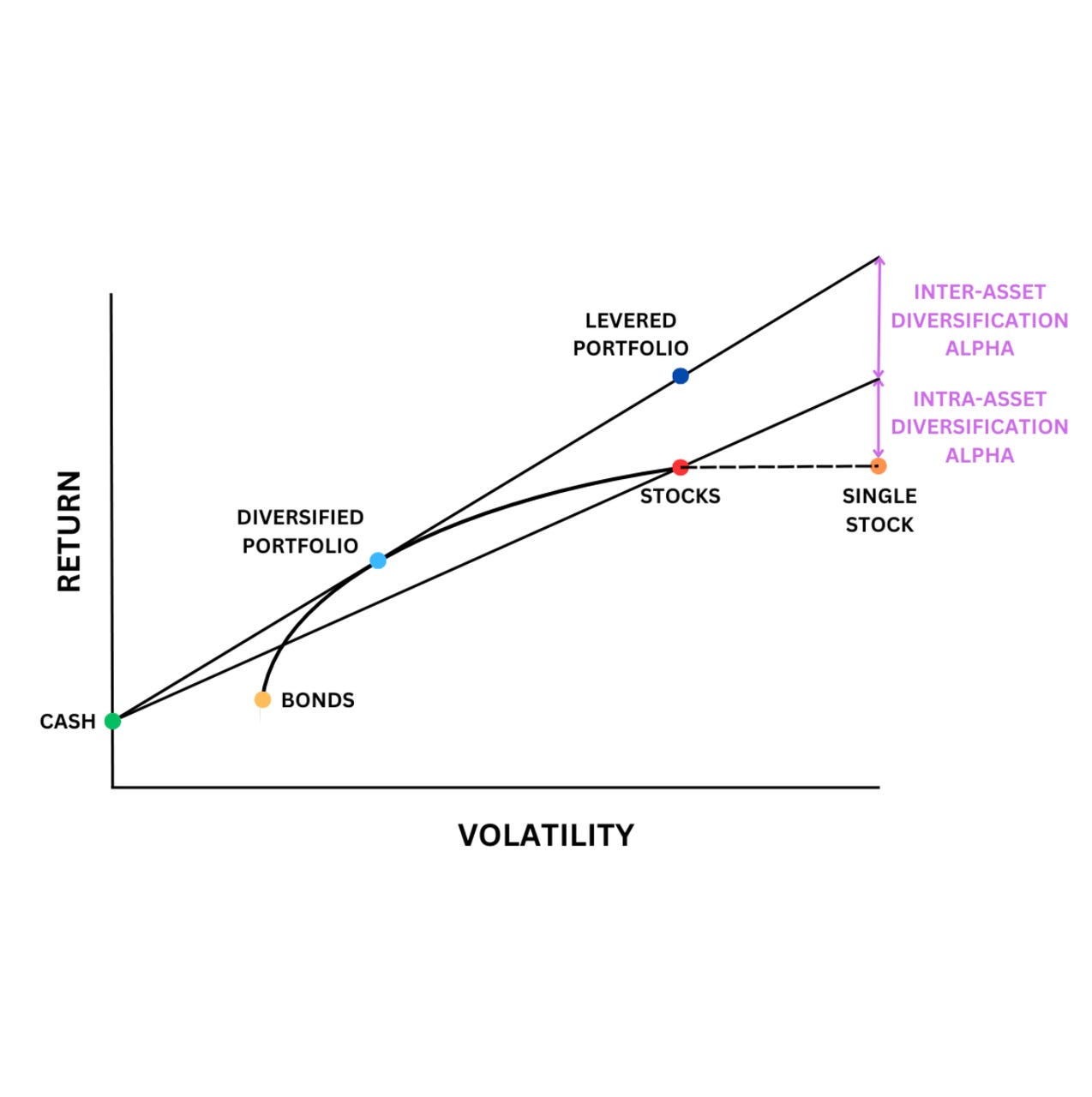

His response was to extend the common efficient frontier idea to include a diversified portfolio with leverage.

He calls the extra risk-adjusted return above holding a single stock Diversification Alpha.

The naive strategy is simple: optimize Sharpe using a diversified portfolio, then lever up.

There’s just one problem…

Volatility drag

I built a tool (sample output below) that shows how this works.