Dave Nadig will present at Basis Northwest plus ETF Return of Capital jam session

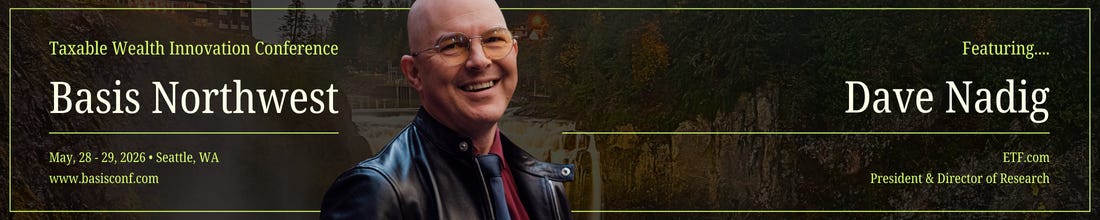

Dave will be at Basis Northwest (May 28-29, 2026, Seattle, WA)

I’m pleased to announce Dave Nadig is presenting at Basis Northwest, my taxable wealth innovation conference (May 28-29, 2026, in Seattle, WA).

Mark your calendars: Basis Northwest registration opens on February 11, 2026 (with a special deal for the first 20 practices that register).

The Tax-Aware Long/Short Working Group will have 1-2 breakout sessions at Basis Northwest.

Make sure to fill out the Tax-Aware Long/Short (TALS) Working Group Participant Survey (TPS).

As of this writing, 67 (yes, that number) of professionals have filled it out.

How do I know Dave?

Sometime in 2024, I sent Dave a cold message on LinkedIn (as one does).

I said I loved his recent post and then posed a quick question...

Did he need any help getting more qualified leads?

I’m kidding. We talked about ETFs and taxes.

For instance, A Comprehensive Guide to ETFs (2nd Edition) (Hill, Kashner, Nadig 2025) has several interesting bits on ETF taxation that later caught my attention.

Then Dave and I decided to pull a thread: ETF return-of-capital distributions.

Is ROC good, bad, a Ponzi scheme? Could they make “income” funds more tax-efficient? Should an ROC fund ever go into a tax-advantaged account? What about estate planning/step-up in basis?

What even is return-of-capital?

My comprehensive flow chart and our discussion are below.

Revisiting ROC is timely. A very large fund company is coming to market with an ROC-powered income ETF soon. This trend/tool/technique isn’t going away.

But first, a return-of-capital meme…