Donating appreciated stocks is NOT always better than donating cash

The AGI limit on tax deductions is higher for cash than for share donations

Tax alpha bulletin board…

🎉 Basis Northwest is my taxable wealth conference. It’s in Seattle in 2026.

🔬 Call for papers… Nathan Sosner, a principal at AQR, is Special Section Editor for the Journal of Wealth Management’s Fall 2026 issue. Submit a paper by Feb 1, 2026.

📗 The Adviser’s Guide to Seeding an ETF In-Kind (via Section §351)

📢 Not Advice Podcast Live: Andre Nader and I are back for another live recording of the Not Advice pod today. Join us on Substack (you’ll receive a reminder email if you subscribe to either of us), or on LinkedIn live, or on my twitter.

“Bigger donation, bigger deduction,” is how most advisers frame the argument to donate appreciated shares of stock.

While that is generally true, there are cases when donating cash on hand is optimal.

Some people really don’t like my Renaissance memes, btw. For them, here is RHCP telling everyone to “Give It Away” about 93 times, which, context aside, is a fine way to start the day.

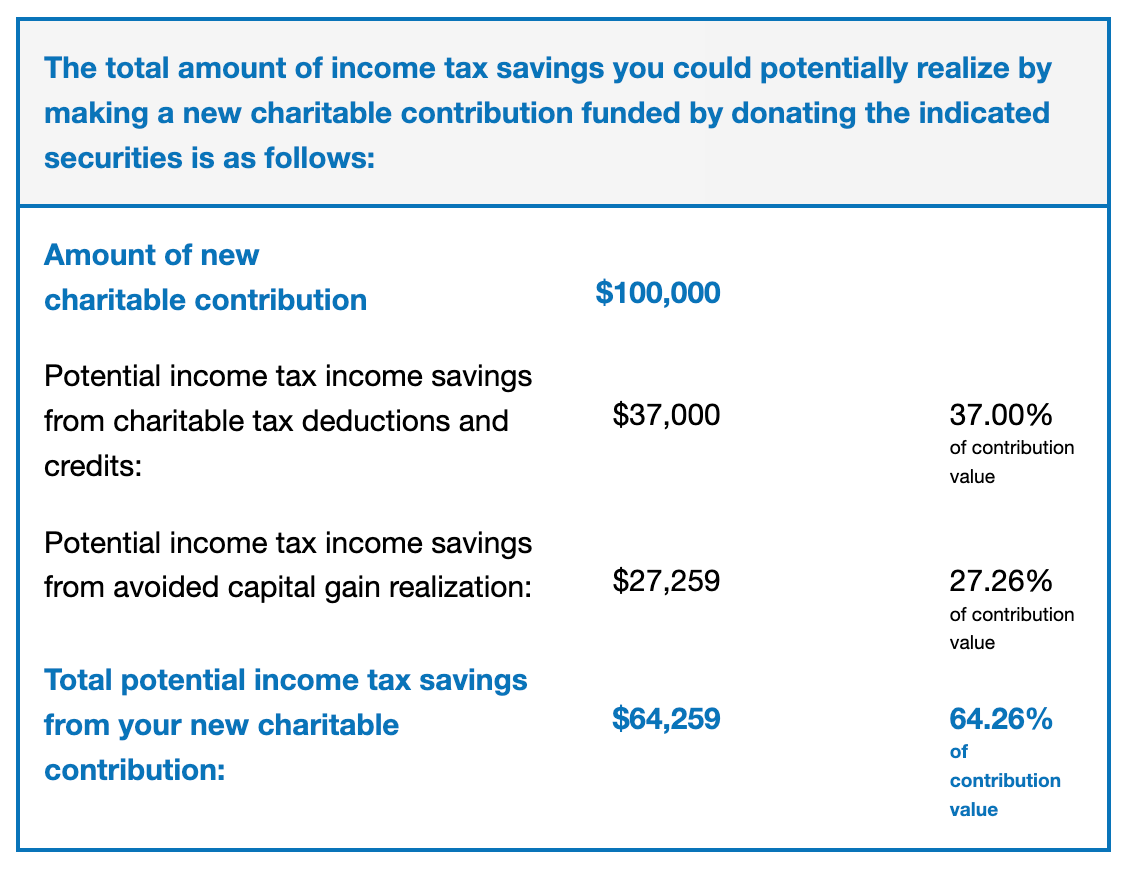

If you need a primer on the value of donating appreciated stock, I recommend playing around with Eaton Vance’s charitable benefit calculator.

When you run the calculator, you’ll get something like the following, but you should enter your own details and see what pops out.

Once you’re done with that, check out the state-level rules, and however annoying, remember that state-level advice is next-level advice.

When should you evaluate just donating cash?