Everyone is catching the long/short bug

We're gonna need a bigger market map

Announcements…

🔨 Job alert: Fast-growing fintech startup hiring a Portfolio Manager to lead exchange fund strategy. Combines quantitative and fundamental investing. 7+ years of experience. CFA or advanced degree preferred. Remote-friendly. Interested? Send me a message.

🔬 Call for papers: JWM - Managing Concentrated Wealth due Feb 2026. Paul Bouchey, a Managing Director at Parametric, is the Editor-in-Chief, and Nathan Sosner, a principal at AQR, is this issue’s Special Section Editor. Submit papers here (due by February 1, 2026).

🎉 Basis Northwest is my 2026 taxable wealth conference. Check out the landing page for more info. Coming in 2026.

Tax-aware long/short is quickly becoming the new standard

It may not be the right solution in every circumstance, but it’s a powerful switch to flip under the right conditions.

Here’s a two-sentence, two-image refresher for anyone needing to get up to speed.

Paid subscribers get my latest market map (lower in this post).

Three notable changes over the past month:

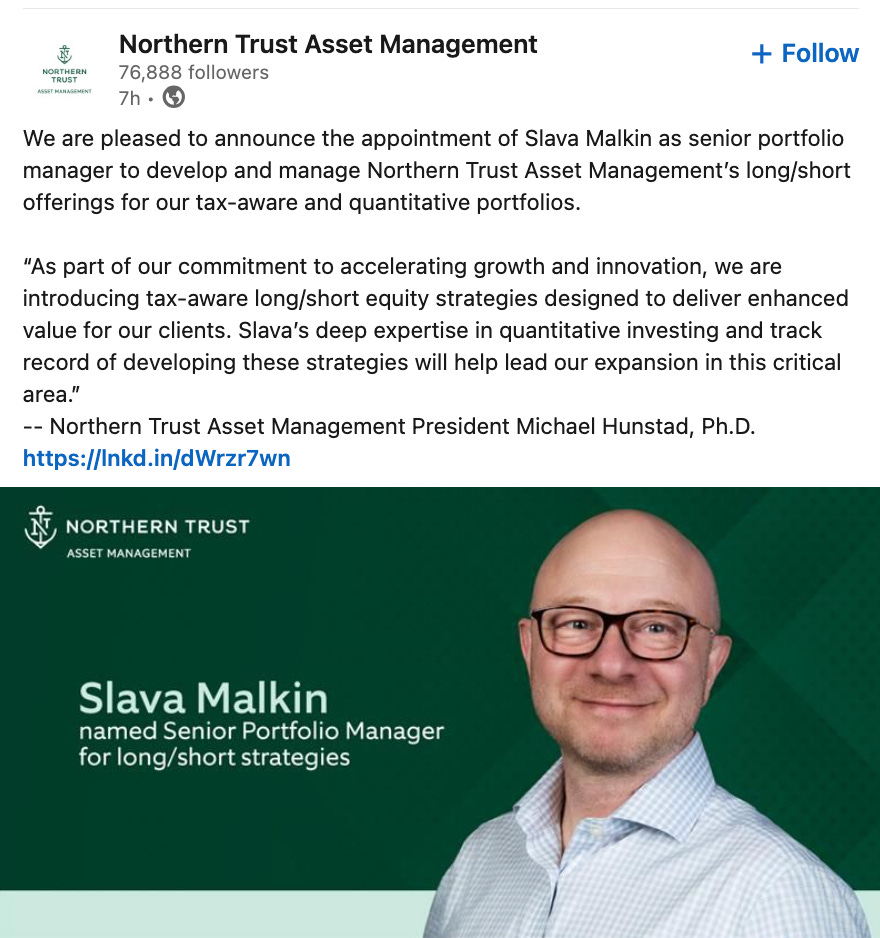

Slava Malkin (former BlackRock/Aperio) joins Northern Trust as a portfolio manager “to develop and manage Northern Trust Asset Management’s long/short offerings for our tax-aware and quantitative portfolios.”

Vise recently launched a tax-aware solution, and I’m excited to get the scoop in the near future.

AUM updates: I expect to have refreshed numbers in 1-2 weeks, but tax-aware long/short appears to have attracted at least another $5bn+ since I last estimated AUM in late August.

Areas I’m researching:

Suitability: For whom and under what circumstances is tax-aware long/short the right solution? Where is tax-aware long/short the wrong solution? What slice of the portfolio is in play? What amount of leverage?

Estate planning: What are the intergenerational planning patterns advisers should have in mind when adopting tax-aware long/short? I spoke with an adviser using a family LLC that plans to hold everything indefinitely for the benefit of multiple generations. I spoke with another adviser who ramped up and down leverage very quickly to address a concentrated position thoughtfully.

I already wrote about the previous long/short hype cycle that happened 20 years ago, but I think I need to go back further (the Dot Com bubble?) to see what could happen under a tech-driven market cycle. Stay tuned.

If you want to sit for an interview, on or off the record, on any of this stuff, please let me know. Advisers, researchers, and attorneys with relevant expertise would be more than welcome.