Future Proof: Gen AI is the biggest thing since blockchain

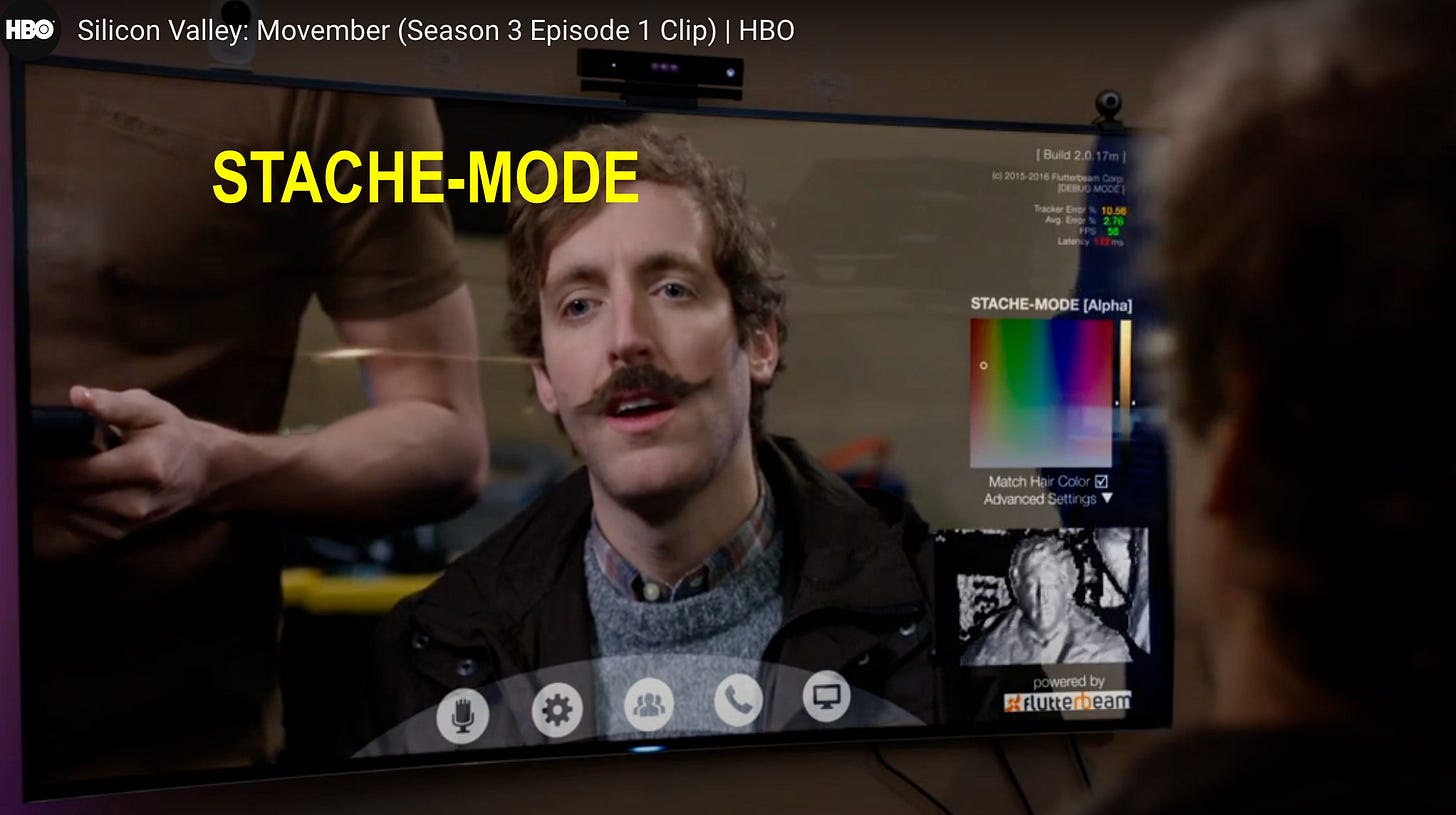

WealthTech enters stache-mode

🔴 I’m hosting a webinar with Burney Advisor Services tomorrow on RIA Channel about tax-aware long/short.

🔴 September 11, 2025 1:00 PM ET - 1 hour - LIVE - Register

WealthTech enters stache-mode

We’ve been here before.

Blockchain, the tech underlying Bitcoin, as a solution to… what exactly?

Own Bitcoin if you want schmuck insurance via the cockroach of t…