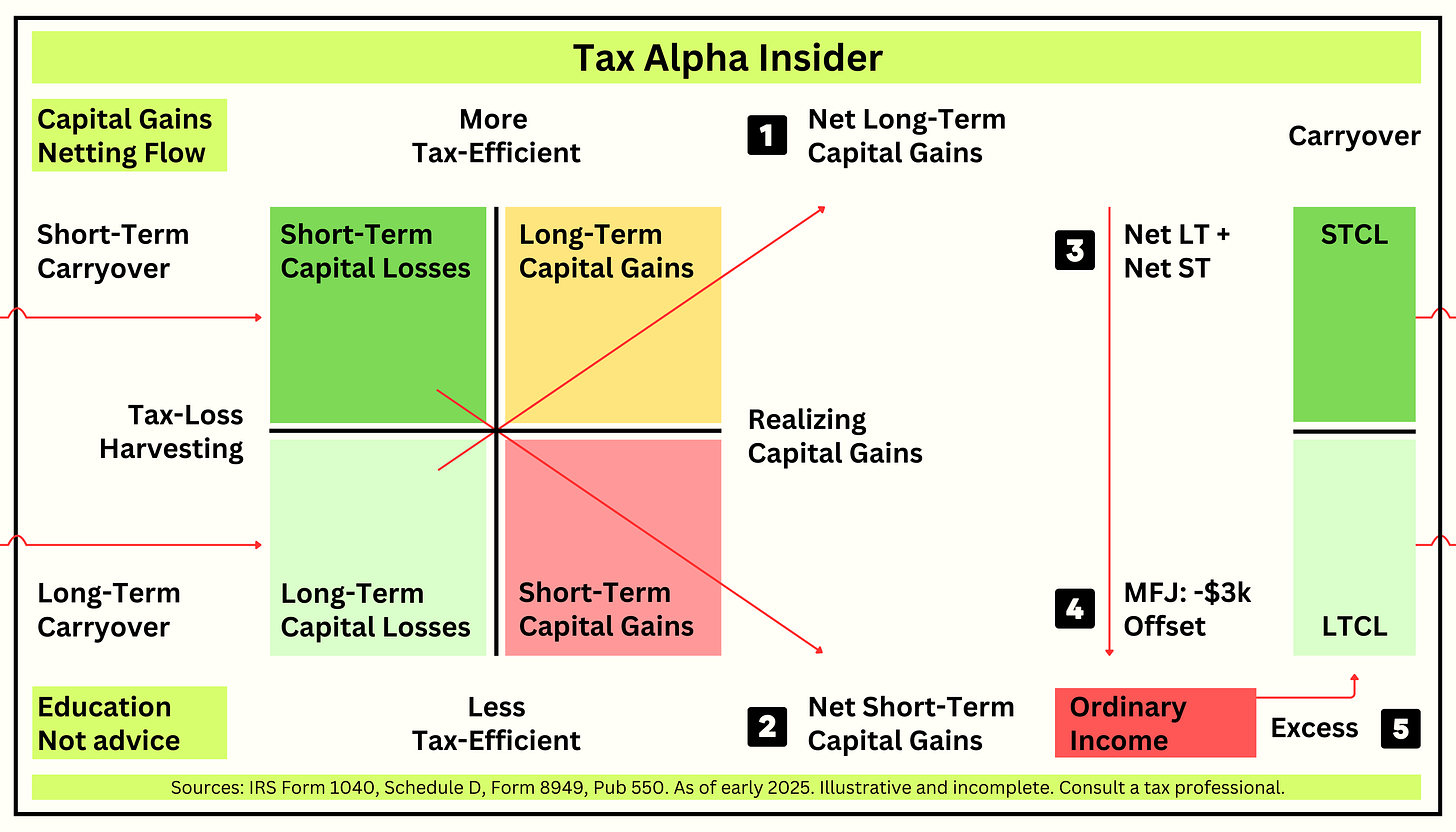

How tax-loss harvesting works on a tax return

An infographic fit for a business card, not tax advice.

T3 Technology Tools for Today is next week. I'm getting my business cards ready.

Pictured: Roughly what's happening on a tax return when someone tax-loss harvests and realizes capital gains.

Net the long-term capital gains and losses (add long-term carryforward losses)

Net the short-term capital gains and losses (add short-term carryforward losses)

“Combine…