"In tax-aware long/short, aren't my tax losses limited to contributed capital?"

It (mostly) depends on the economic value at risk, which is a function of the wrapper

Tax alpha bulletin board…

🎉 Basis Northwest is my taxable wealth conference. It’s in Seattle in 2026.

🔬 Call for papers… Nathan Sosner, a principal at AQR, is Special Section Editor for the Journal of Wealth Management’s Fall 2026 issue. Submit a paper by Feb 1, 2026.

This is an educational article about the taxation of separate accounts and hedge funds organized as partnerships. This is not investment, tax, or legal advice. Consult an adviser for personalized guidance.

Several months ago, a wealth manager asked me if tax-aware long/short separate account capital losses were limited to contributed capital.

For example, if I contribute $1 to a tax-aware long/short separate account (130/30, 250/150, etc.), then can’t I only tax-loss harvest up to $1 in capital losses?

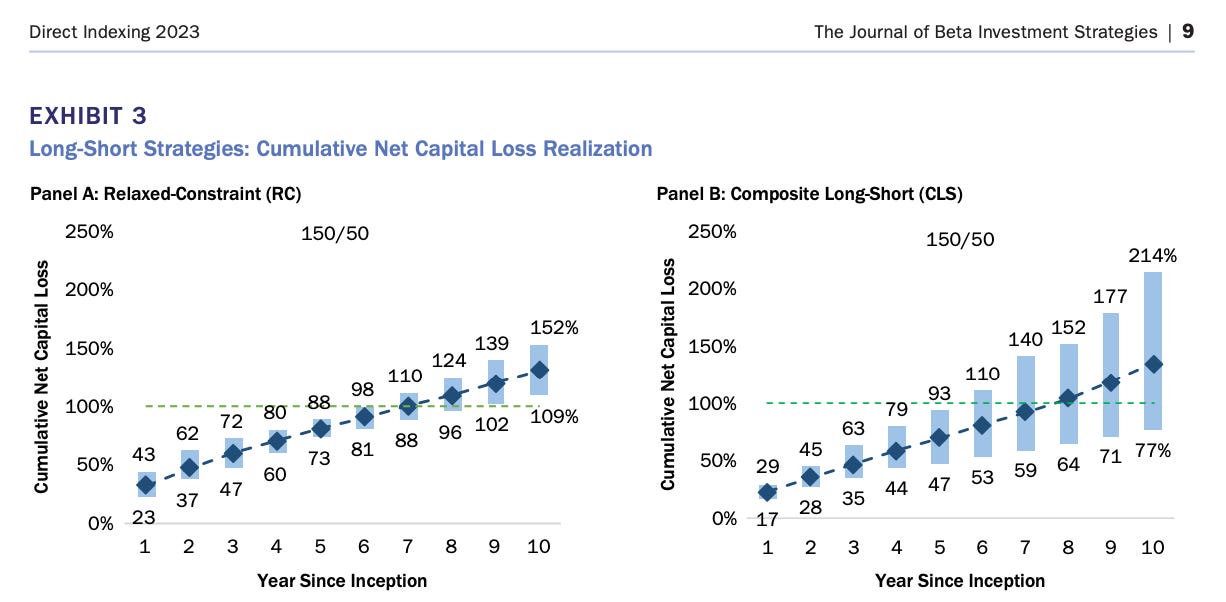

This question surprised me since plenty of research on tax-aware long/short strategies, delivered via separate account, shows capital losses exceeding 100% of contributed capital.

For example, here are AQR’s 150/50 backtest results, showing cumulative capital losses after 10 years of around $1.30 for every $1 contributed (see their paper for methodology).

It seems to me the wealth manager was exporting his knowledge of hedge-fund taxation to the separate account wrapper, but they’re different beasts.

“…the economic investment loss exposure of a limited partner in a fund can be far more limited than that of a separate account investor,” AQR researchers commented in their 2018 paper Partnership Allocations and Their Effects on Tax-Aware Fund Investors (Part. 2018).

I am not suggesting that separate accounts are subject to the same rules as hedge funds organized as partnerships. They generally are not. But I think we can build some intuition about separate account taxation using the hedge fund rules.

We need to look at what an investor stands to lose…