Is Your Alpha Big Enough to Cover its Taxes? (Jurassic Park edition)

1993 was a blockbuster year

I can think of around 20 ways to thoughtfully de-risk a concentrated public stock position. The “right” solution is in there somewhere. Learn more at Basis Northwest.

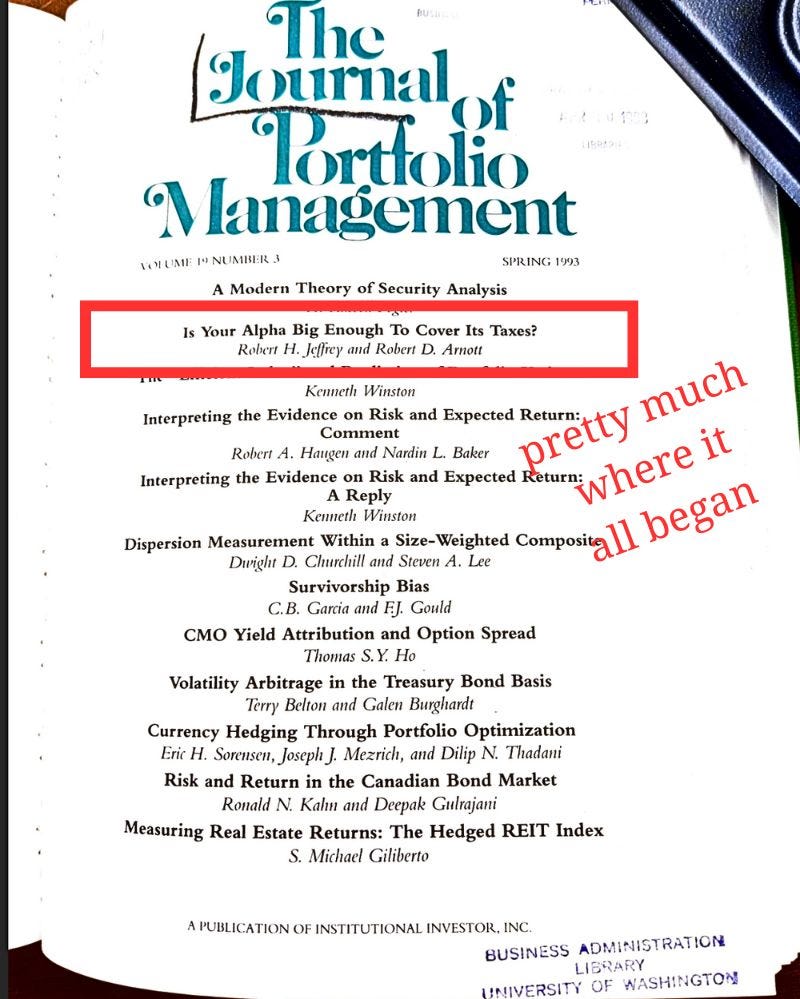

In 1993, Jurassic Park premiered, and so did Jeffrey and Arnott’s Is Your Alpha Big Enough to Cover Its Taxes?

Without exaggeration, I can say that this paper launched my interest in taxable wealth.

There’s something rebellious about this paper…

“We conclude that the typical approach of managing taxable portfolios as if they were tax-exempt is inherently irresponsible, even though doing so is the industry standard.”

At the time, most folks knew that active management tended to underperform, but Jeffrey and Arnott introduced a simple model (replicated below) that made the underperformance intuitive and mechanical.