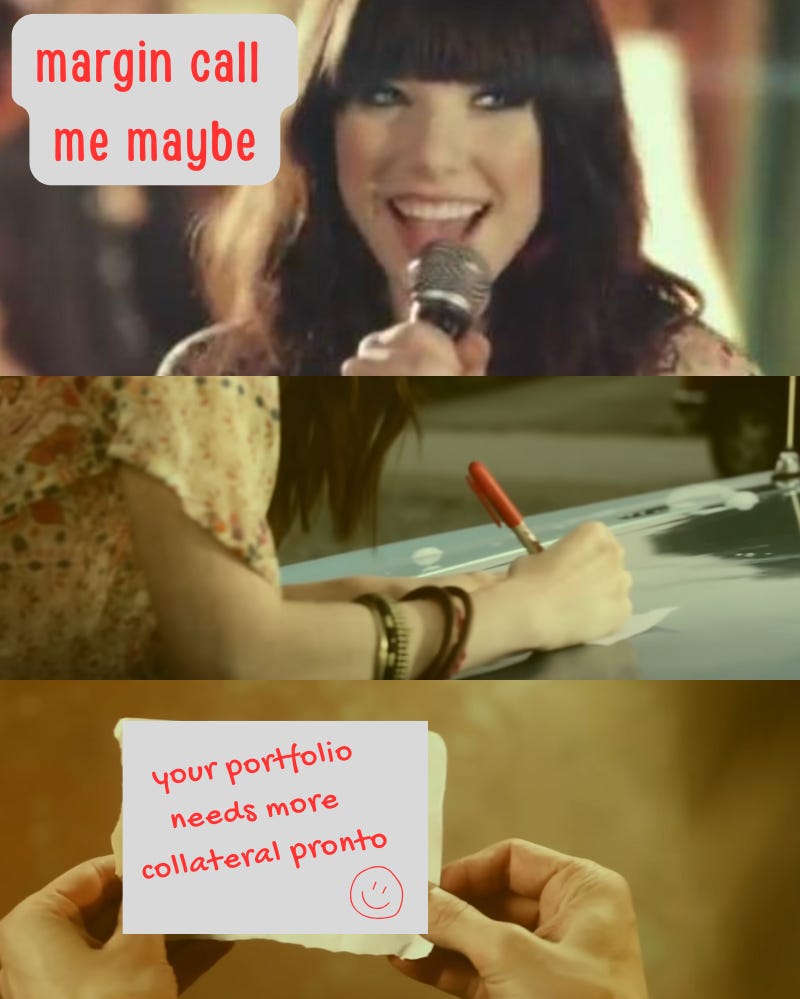

Margin call me maybe

New products using margin deliver tax efficiency, but at what cost?

Two of the hottest trends in private wealth are tax-aware long/short and borrowing via box spread.

Both have substantial pre- and post-tax perks, and both use margin.

That’s fine… when prudently managed.

This week, I’m taking the tax benefits of these products for granted and instead asking…

Is margin call risk a big deal?

Mentioned in this article…

NBER (Gary B. Gorton & Andrew Metrick): Securitized Banking and the Run on Repo

Basel Committee on Banking Supervision: Review of margining practices

Firstrade: Margin Loans (several worked examples)

AQR: Experience Matters: Addressing Five Common Criticisms of Tax Aware Long-Short (TA LS) Strategies

Underwriting margin call risk

What could go wrong?

Not all margin call risk is the same

Why should we care about margin calls?

What could cause a margin call? (6 rug-pulls)

Who’s in charge of the margin?