Opportunity zone investing is real estate investing

Who gives a shit about tax benefits if the investment tanks?

This article is educational content, not investment, tax, or legal advice. Hire an adviser or tax attorney for personalized guidance.

Tax alpha bulletin board

🎉 Basis Northwest: 2 days of taxable wealth innovation 👉 Seattle - May 2026 (💎details coming soon… dates/venue/planner selected… 💎)

🔬 Call for papers: JWM Fall 2026 issue on concentrated wealth due Feb 1, 2026

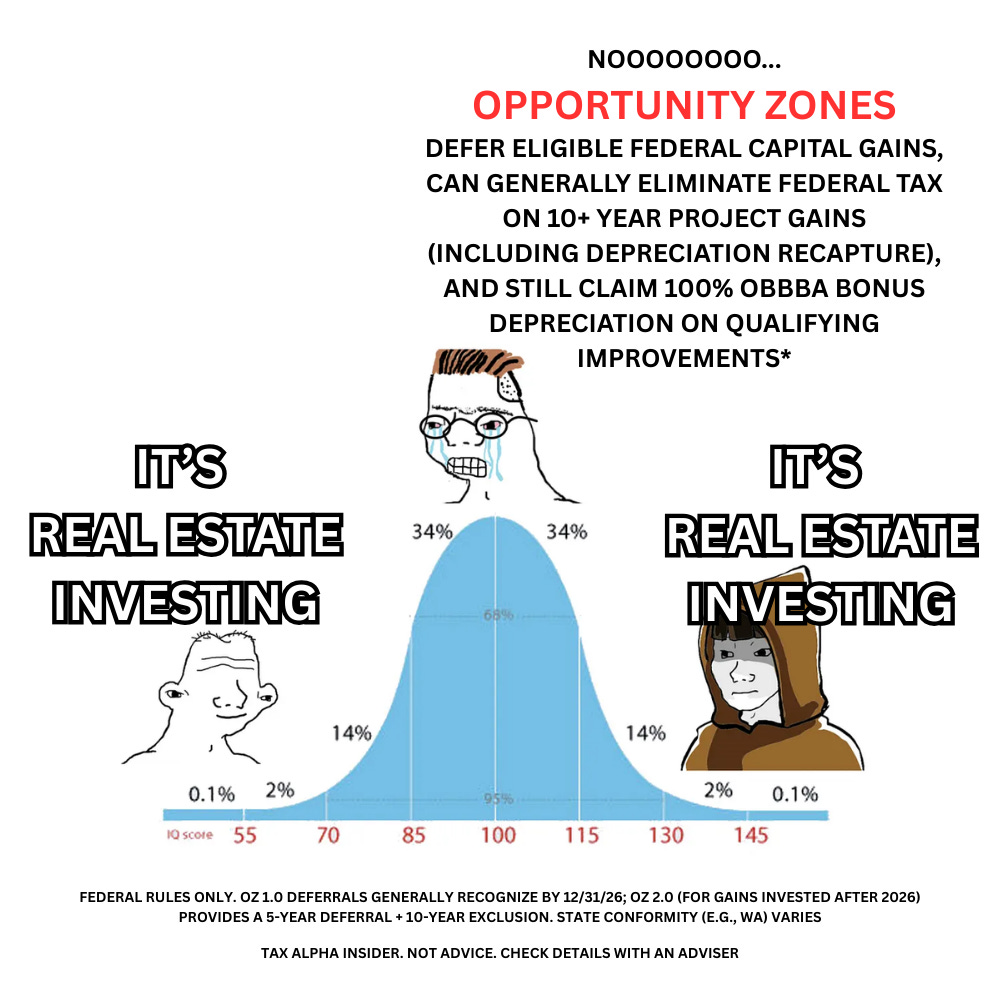

Opportunity zone investing is real estate investing

I’m just dipping my toes into the Opportunity Zone story.

I spoke with a handful of developers and allocators recently, and many said the same thing: Opportunity Zones were an “experiment” created by the TCJA (2017), but now that OBBBA has made them permanent, the real build begins, and the program will “explode.”

“Explode,” of course, has two meanings: Grow substantially or lose a lot of money.

From a tax perspective, OZs are compelling. But it would be ridiculous to only look at it from that angle.

We need to consider…

Real estate allocation

Risk management and fund diligence

Policy

…before even looking at Opportunity Zone stuff.

Many in the RIA community are skeptical of Qualified Opportunity Funds, funds focused on real estate development in Qualified Opportunity Zones, because, in my mind:

The pitch usually leans heavily into the tax benefits (🚩🚩🚩) rather than diligence/risk of the underlying properties. Who gives a shit about tax benefits if the investment tanks?

Several socially-minded studies show that the Opportunity Zone program may benefit rich people rather than low-income communities. At the very least, this is optically problematic, and at most, a social and policy lightning rod.

These two things rub allocators the wrong way.

Yes, the incentives are a little complex and mechanically interesting, but when I look at a QOF pitch and an institutional real estate pitch, the stories are completely different. Neither is great. But the institutional one is pure investing, including lots of risk management. It’s usually devoid of tax stuff. Oops. But at least it gets the lede right. Neglecting risk in favor of tax is very bad.

Anyway. QOF sponsors need to address both issues in substance and form, and many are getting the message; I expect improved comms over the next year as OZ 2.0 planning starts in earnest.

The leader in planning is a company we don’t really hear much about in the stocks/bonds/derivatives investing world: Novogradac, an accounting firm. Their Opportunity Zones Resource Center is generally considered the authority on all things Opportunity Zones.

In late September, they updated their deal tracker, which follows about $43 billion in equity raised (see timeline visual below), though the total equity and debt is likely substantially higher.