Payment in lieu is taxing you

Securities lending might mean paying more tax.

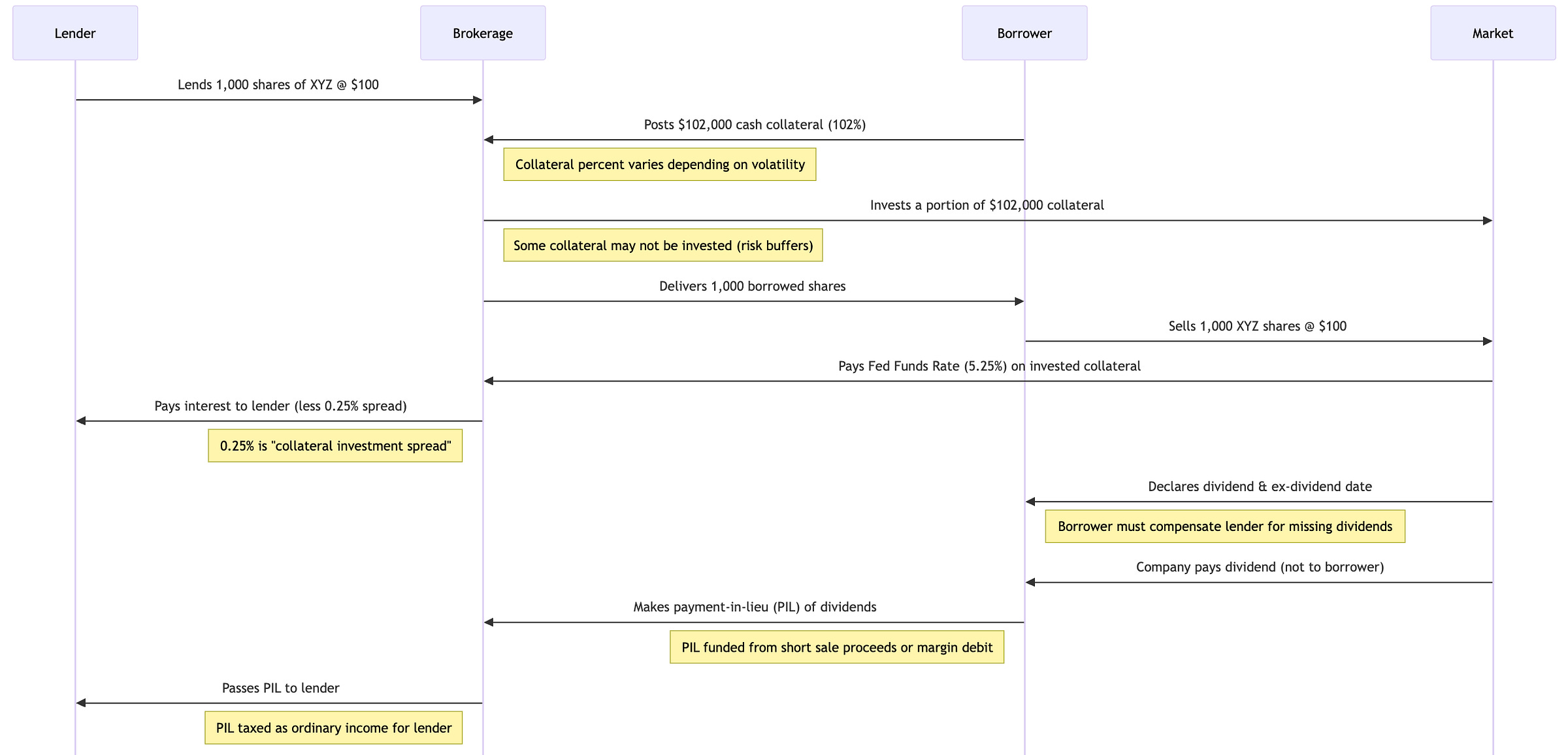

Most major brokerages lend securities to short-sellers. The lender could be an ETF or individual investor. Securities lending is big business.

The short-seller/borrower owes any dividends received to the lender.

But a borrower can’t make a dividend payment, l…