If tax-loss harvesting cushions downside, shouldn't investors take more risk?

Partners Capital (2019) argues more equity-like risk is appropriate for taxable investors

Weekly reading from taxable wealth

Parti Pris: Rules-Based Rebalancing vs. Risk-Based Optimization

Vise: 15 years ago "Enterprise RIA" wasn't even a term

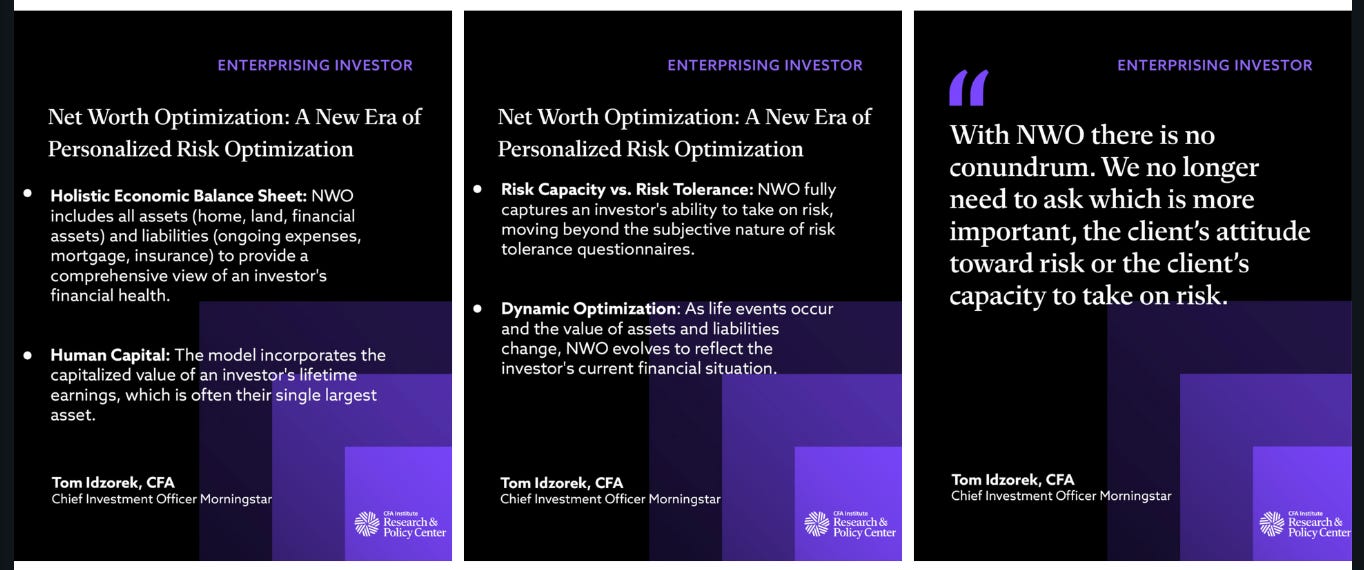

Morningstar: Net Worth Optimization

Most investors use pre-tax returns and volatility to size risk

But taxes soften gains and losses.

Partners Capital (2019) argues taxable investors should take more risk.

I drew the picture above based on the assumptions in their paper.