The ETF share class proves the staying power of the mutual fund

Advisers will have more ways to invest retirement account assets and lower transaction costs.

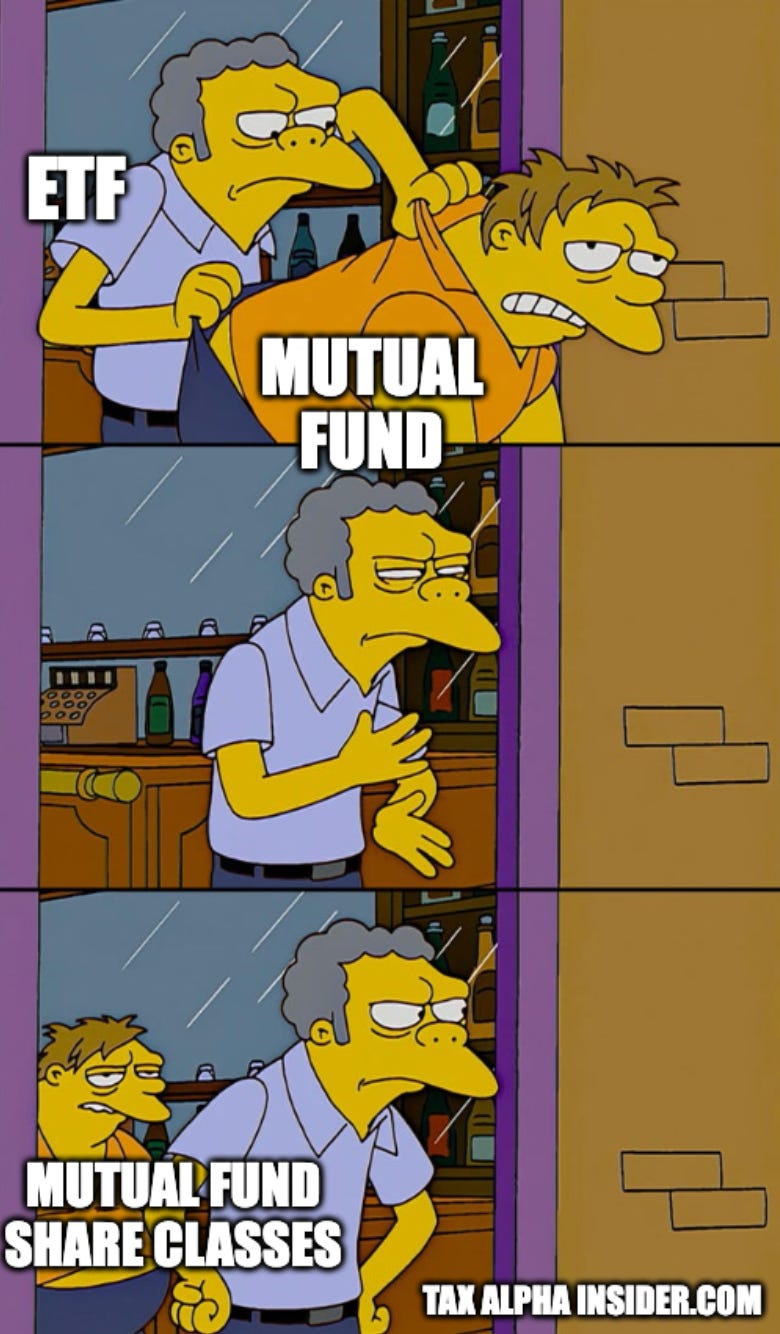

Mutual funds are dead, or dying, or maybe actually growing?

Even though more than 50 mutual fund sponsors have petitioned to add an ETF share class, the real story might be the dozens of ETF sponsors who have petitioned to add mutual fund share classes.

Why would they do that? Well…

Share-class flexibility is to 401(k)s what tax efficiency is to ETFs

Tax Alpha Insider

I’ll return to that point later, but for now, why should advisers care?

Advisers should be able to access previously ETF-only strategies in qualified accounts like 401(k)s and 403(b)s (e.g. F/m Invest’s strategies)

Pricing for some ETFs might be lower in qualified plans via mutual fund institutional and retirement share classes

ETF in-kind redemption should lower transaction costs for mutual fund share class holders

There is some “tax contagion” risk for taxable investors in mutual fund/ETF dual-class funds

The backstory

“The ETFs adding mutual fund share classes will NOW have a ‘real’ tool to drive distribution,” Bill Poulin, a 35-year fund executive, and consultant to fund company boards, told me on a call last week.