The taxable wealth revolution

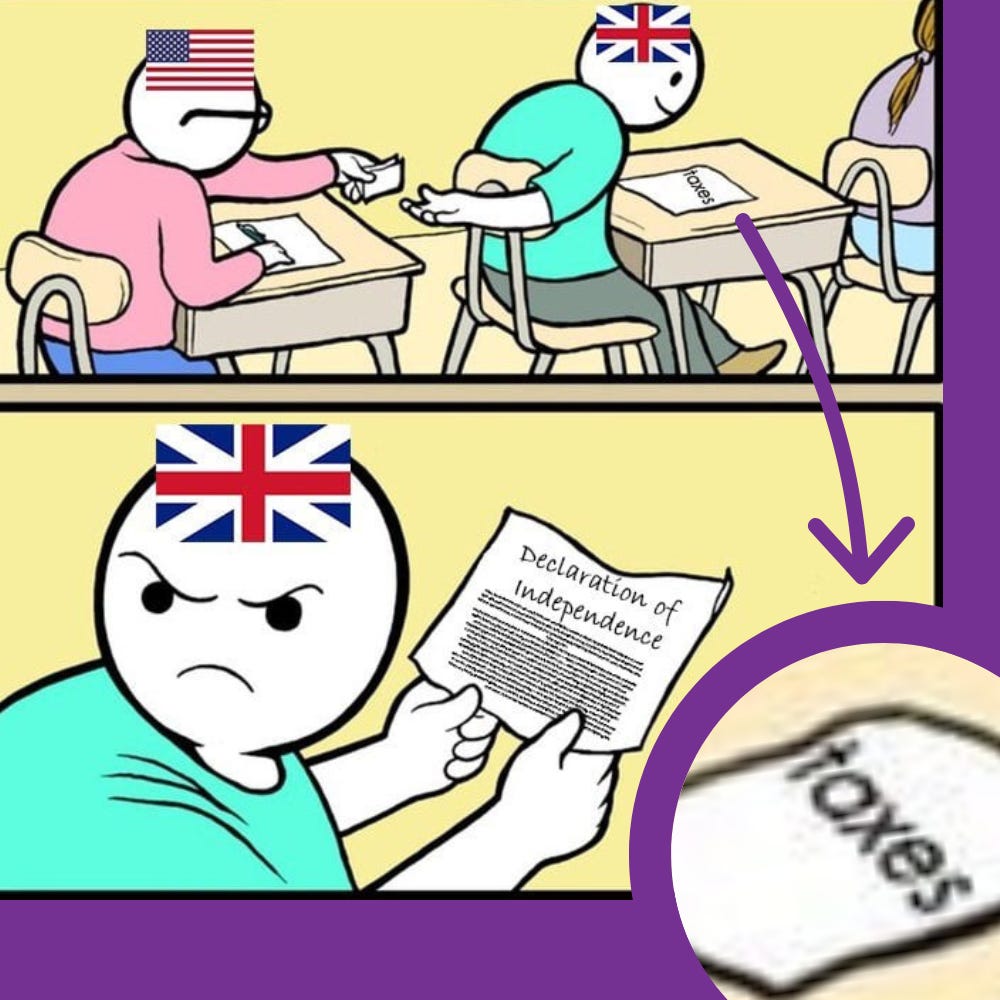

Happy Fourth of July

Taxable wealth: What I’m reading…

Quisenberry, Welch (2005): Increasing the Tax-Effectiveness of Concentrated Wealth Strategies (variable prepaid forwards + direct indexing)

Santa Barbara Management: A Wealth Strategy for Taxable Families

AQR: Combining Charitable Remainder Unitrusts and Tax-Aware Strategies to Diversify Lo…