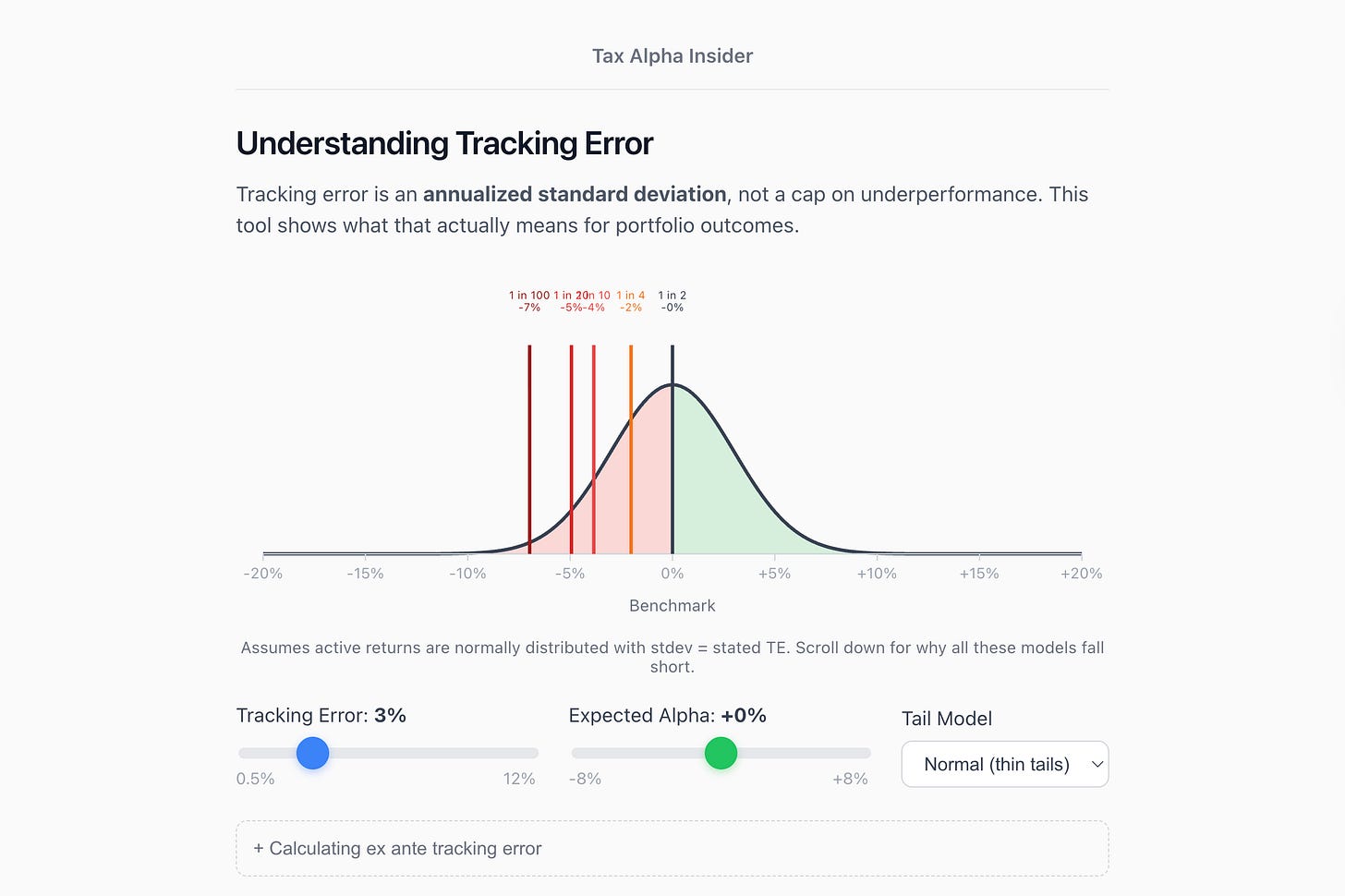

What does 1% tracking error really mean?

And how likely is it that I underperform by more than tracking error?

Basis Northwest registration opens on February 11, 2026.

Tracking error is beguiling for most folks.

The most common misunderstanding is something like “if my tracking error is 1%, then my strategy will only underperform by 1%.”

Most understand reality to be far more brutal, and yet many are flabbergasted when their client portfolios underperform the ex ante (literally “from before,” or the predicted) tracking error.

So, I built a tool that illustrates how tracking error works, giving advisers a better, though still imperfect, sense of the risk their portfolios bear.

AQR wrote a very brief note on tracking error, essentially asking investors to consider whether it is incidental or deliberate and whether it is well compensated.

This is an important point, but it opens a whole other can of worms, namely the active vs. passive debate.

I’ll table this discussion for now, but suffice it to say that “active” comes in all shapes and sizes, and several thriving investment managers have delivered meaningful results for clients by looking at factors instead of naive market capitalization (including AQR, DFA, O’Shaughnessy and Canvas, Burney Advisory Services, Research Affiliates, Alpha Architect, and more), and by embracing tracking error and making sure it is well compensated risk.

In any event, in this article, I (very) quickly recap what tracking error is, provide some intuition about what investors can expect given a particular tracking error, and then link to my tracking error visualization tool.