Trader fund Excess Business Loss (EBL) limit gets worse in 2026

The donut shop example. D'oh!

Bulletin board…

📗 The Adviser’s Guide to Seeding an ETF In-Kind… I printed another 5 copies (4 left!)

🔬 Call for papers… Nathan Sosner, a principal at AQR, is Special Section Editor for the Journal of Wealth Management’s Fall 2026 issue. Submit a paper by Feb 1, 2026

Trader fund Excess Business Loss (EBL) limit gets worse in 2026

This is an educational article about the taxation of hedge funds that have made the trader determination. This is not investment, tax, or legal advice. Consult an adviser for personalized guidance.

Lately, I’ve been writing about trader funds (what are they?) and how they allow investors to deduct expenses, like management fees, and pass through ordinary business losses under certain circumstances, which may offset wages.

These funds are generally only available to accredited investors who are also qualified purchasers, but they are powerful planning tools, and people ask me about them all the time.

Business losses from trader funds may offset ordinary income, including wages, but losses generally need to pass through a four-phase gauntlet before getting to investors, including…

Basis limitation: §704(d)

At-risk rules: §465(a)(1)

Passive activity loss rules: §469(a)(1)(A))

Excess business loss limitations: §461(l)

These limitations are applied in this order, with the Excess Business Loss (EBL) limitation being the most recent addition.

The limit amount is explicit in IRS Form 461.

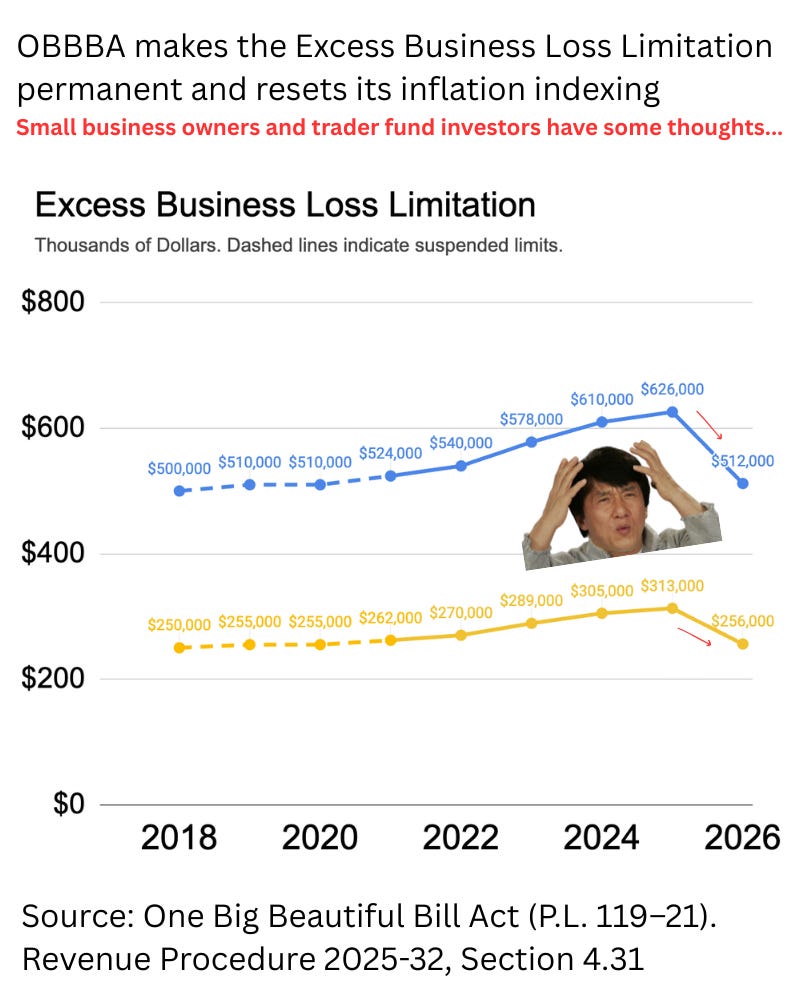

Here is a history of the limits and how they’ll evolve, surprisingly, in 2026…

If you’re wondering why the EBL limits will go down in 2026, you are not alone.

But I’m getting ahead of myself.

The rest of this article is…

The legislative history of the EBL limitation

Why the EBL limit goes down in 2026

The donut shop example: How EBL limits deductions counterproductively

The donut shop example: How EBL transforms into NOL, which is also limited

If you are diligencing trader funds, then a deep understanding of EBL will make you a more effective planner.

Let’s go!