With stocks at all-time highs, reasons to diversify are apparently at all-time lows

A certain slice of humanity loves concentrated risk

Basis Northwest topics… Concentrated position management, tax-aware long/short separate accounts and hedge funds (along with the inaugural in-person meeting of the practitioner working group), private placement life insurance (PPLI), private assets and tax alpha (you better believe it), exchange funds and exchange-traded funds, householding and comprehensive wealth. Learn more about Basis Northwest.

Reply to this message if you’re interested in sponsoring or want to recommend a topic or speaker.

Welcome back to work after a long, hopefully relaxing weekend.

Friends in the industry are collectively wondering when their friends, family, and clients will take a few (highly concentrated) chips off the table.

Although continuing to hold a concentrated stock might seem like a status-quo stance, it is, in fact, one of the most risky investment strategies an investor could pursue, and it is especially problematic for those wealth creators who seek to become guardians of wealth for themselves and their families… Bessembinder (2018) shows that, during the 1926–2016 period, for all the 25,967 common stocks in the Center for Research in Securities Prices (CRSP) database, by far the most frequent one-decade buy-and-hold return is -100%.

But, of course, a certain slice of humanity loves concentrated risk, and there’s a huge counternarrative…

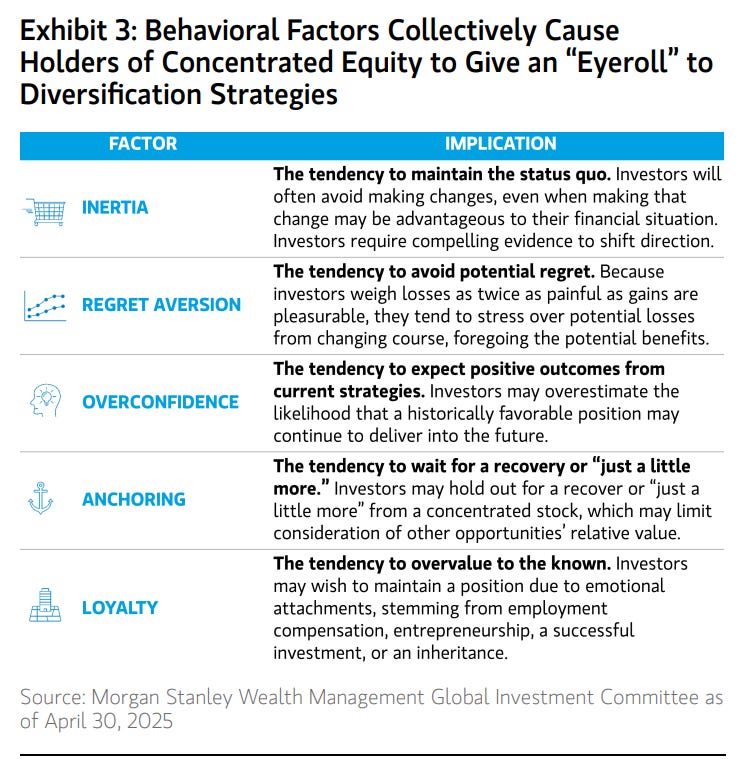

For the third post in a row, I will copy/paste Morgan Stanley’s “eyeroll” table of reasons people continue holding concentrated positions. We should, apparently, include “Hindsight” as another reason.

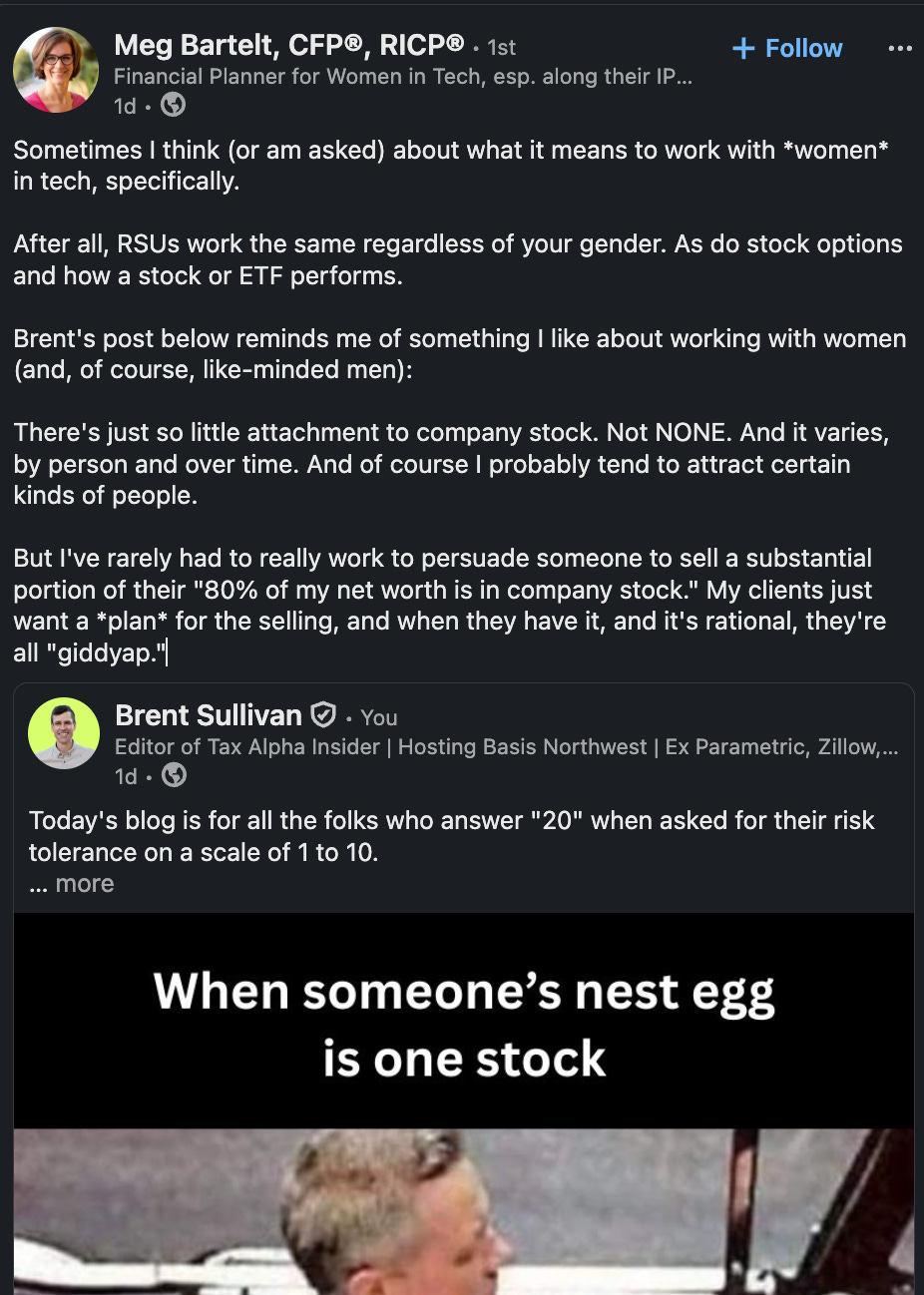

Relatedly, Meg makes an interesting point by arguing that holding “the one” stock is kind of a male thing.

Latest Tax Alpha Trends

With markets near all-time highs, concentrated position management is the top line of the latest issue of Tax Alpha Trends (below).

Tax Alpha Trends is a one-pager about hot topics in taxable wealth for HNW/UHNW advisers. It is the radar that I frequently have in front of me when folks ask, “What’s on your radar?”

You can see every issue of Tax Alpha Trends going back to 2023 here…