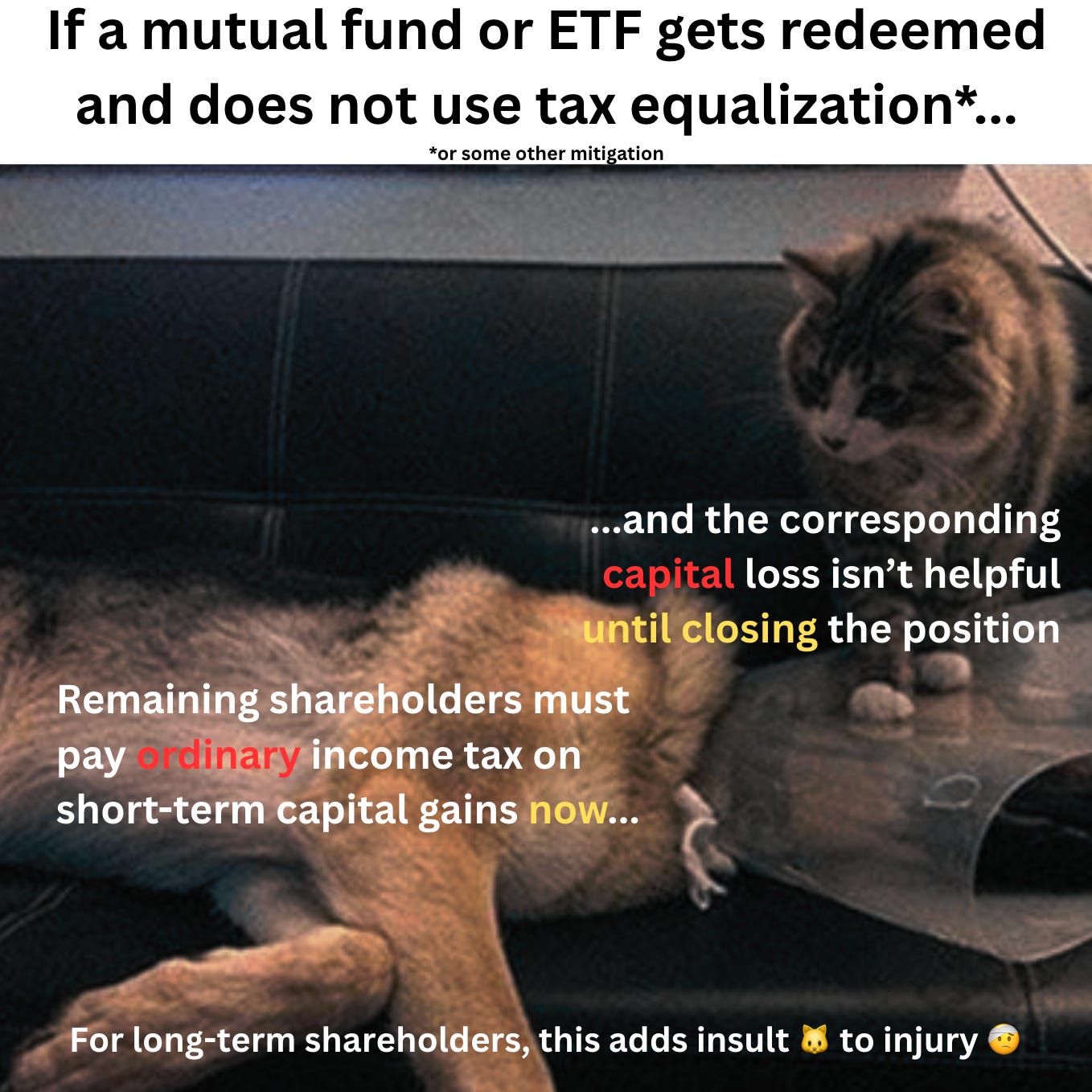

Add tax equalization to your mutual fund and ETF diligence checklist

Equalization generally protects long-term investors

🎉 Basis Northwest is my 2026 taxable wealth conference. Check out the landing page to learn more about attending, sponsoring, or speaking.

Nothing in this article is investment, tax, or legal advice. The examples are illustrative. Fund practices and IRS interpretation may evolve. Consult an adviser for personalized guidance.

You probably haven’t heard of tax equalization

But many mutual funds and ETFs use it to protect long-term investors from negative tax consequences when others redeem their shares.

“ETFs are regarded as tax-efficient products. Tax-efficient costing methodologies, wash sale activity, the use of tax equalization, in-kind contributions, and in-kind redemptions all impact ETFs.” (State Street, 2010)

Mutual funds may also use a credit facility, and, believe it or not, in-kind redemption.

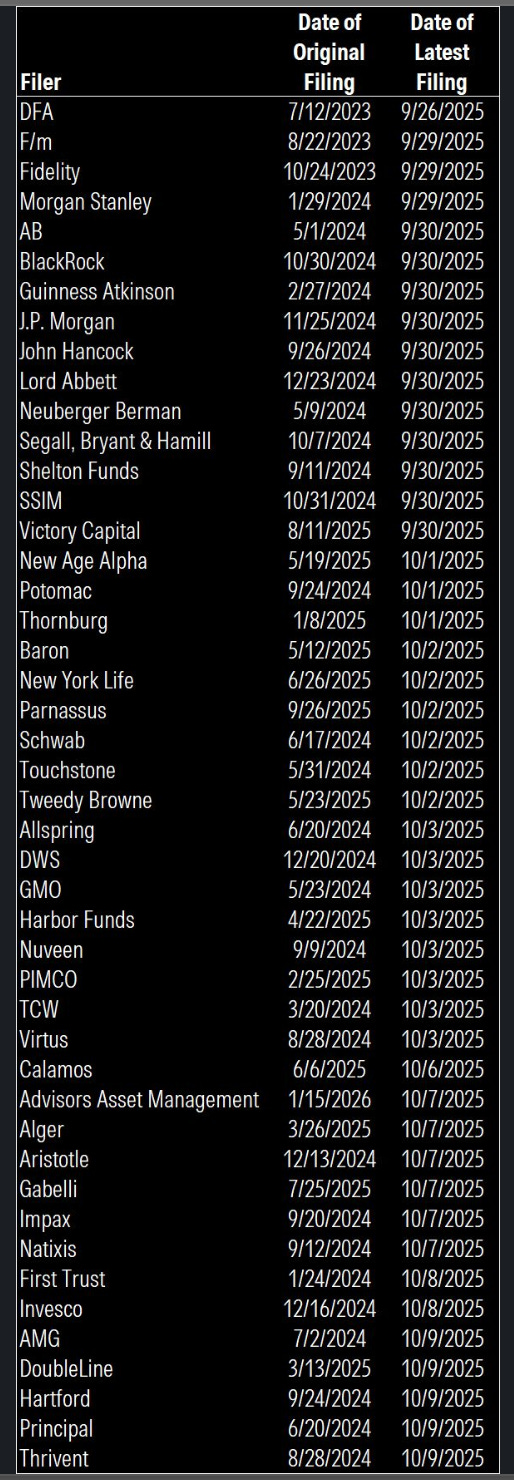

I mention this now because many mutual funds are petitioning to add ETF share classes.

Naturally, investors and advisers are wondering if the ETF share class could get punished for being attached to a tax-inefficient, cash-buffering mutual fund.

Possibly.

But tax equalization should help, and this article illustrates how it works.

Background reading for this article:

Tax Notes (Stephen Fisher, 2019): A Loss Cause: Fixing the Rules Governing Mutual Fund Losses

Tax Notes (Mark Leeds, 2024): The BOXX Anomaly: ETF Tax Enhances Inverted Yield Curve Strategy

Chapman and Cutler LLP (2024): ETF Share Classes: A Path Forward

State Street (2010): ETF Servicing: Moving Forward in a Market in Motion

This is a dense little chunk of Regulated Investment Company (RIC) taxation, and the only way I can think of getting it across is through song.

I’m kidding. Rather than song, I illustrated some numerical examples to compare RIC redemptions with and without tax equalization.

Here we gooooooo!