How do you use tax-aware long/short, if at all?

Different hold patterns for different scenarios

Tax alpha bulletin board…

🎉 Basis Northwest is my taxable wealth conference. It’s in Seattle in 2026.

🛠️ Jobs (message me for more info)…

Job: Fast-growing exchange fund startup looking for 7y+ PM with execution experience

Candidate: Harvard PhD looking for quant roles in taxable wealth research

Looking for talent? Tell me how I can help

🔬 Call for papers… Nathan Sosner, a principal at AQR, is Special Section Editor for the Journal of Wealth Management’s Fall 2026 issue. Submit a paper by Feb 1, 2026.

📗 The Adviser’s Guide to Seeding an ETF In-Kind… Buy the 1 remaining physical copy

I’m curious how advisers use tax-aware long/short strategies.

These strategies use leverage and are actively managed.

The perks are pretax alpha and capital losses.

The downsides are potential underperformance and higher costs (fees, t-costs, financing).

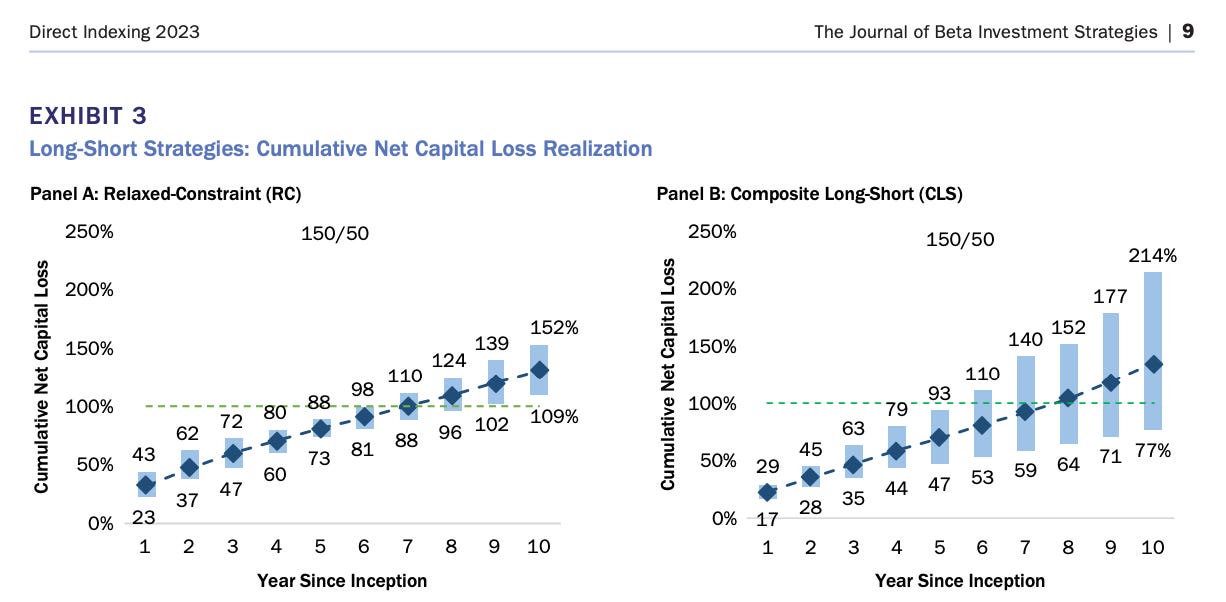

Here’s a two-sentence, two-image refresher on tax-aware long/short and an example of backtested capital losses from AQR (please read the paper, it’s a good one!, for backtest details).

Also…

Please help me out and answer this poll about how LONG you plan to hold a tax-aware long/short strategy, if at all.

If this question puzzles you, it may be because tax-aware long/short is not your typical separate account strategy.

Many managers allow clients to dial leverage up (more tracking error, possibly pretax alpha, plus more cost) and down (less tracking error and lower cost) per their needs.

So, tell me what's driving your advice. I'm very curious about war stories and success patterns.

I will share the results next week.

How long advisers/investors plan to hold the leverage is important

Here’s an example from an experienced adviser talking about his personal circumstances.