Individual investors can seed ETFs in-kind thanks to an exception to an exception

The PARTNERSHIPS Act seeks to explicitly classify RICs as "Investment Companies"

This article is educational content, not investment, tax, or legal advice. Hire an adviser or tax attorney for personalized guidance.

Tax alpha bulletin board

🎉 Basis Northwest: 2 days of taxable wealth innovation 👉 Seattle - May 2026

🔬 Call for papers: JWM Fall 2026 issue on concentrated wealth due Feb 1, 2026

Individual investors can seed ETFs in-kind thanks to an exception to an exception

I’ve written about the hot “new” (it’s not new) phenomenon of everyday folk seeding ETFs in-kind dozens of times over the past year.

Recent examples include Alpha Architect’s AAUS, and several funds from Cambria: TAX, ENDW, GEW, and JLens’ TOV, Longview's EBI, among many others.

I self-published a book about it (there are still a few copies).

This is all possible because of IRC § 351, which says “No gain or loss shall be recognized” if several conditions are met.

For fun, I recently re-read § 351.

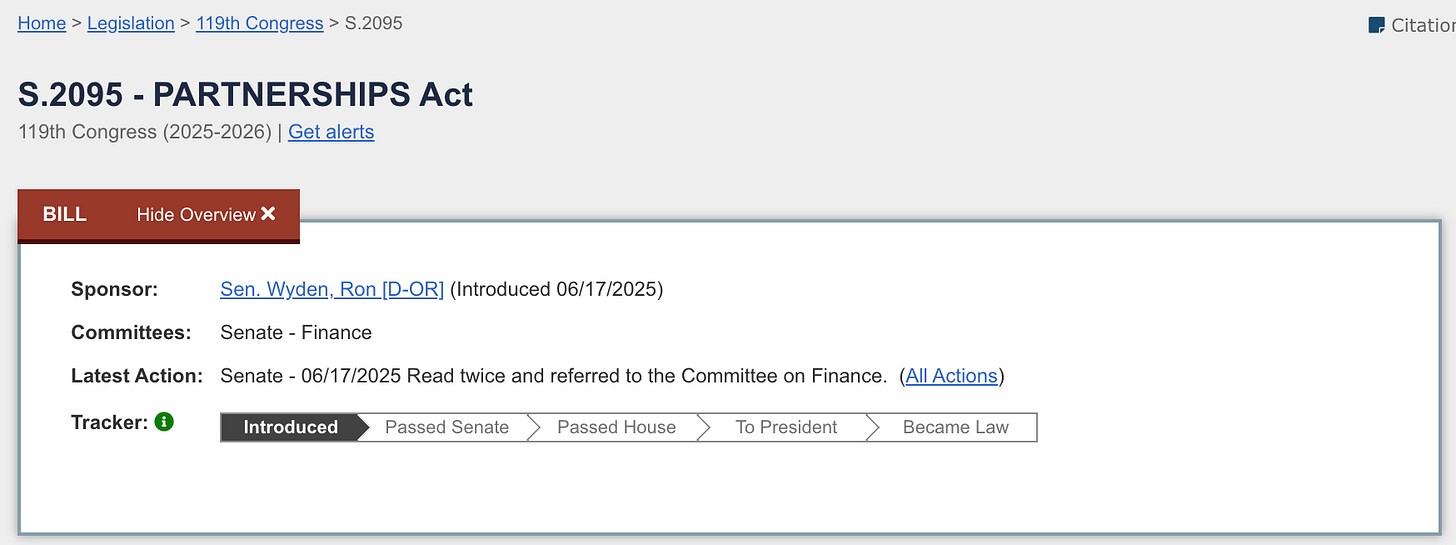

I also read the legislative text of the PARTNERSHIPS Act (introduced in June 2025), which seeks to amend § 351(e) to explicitly require gain recognition for transfers to corporations registered under the Investment Company Act of 1940 (e.g., ETFs)1.

This bill hasn’t gone anywhere in the 6ish months since it was introduced.

It’s certainly worth monitoring, but the current wording suggests any change will be applied prospectively2.

To understand how § 351 works and what the PARTNERSHIPS Act seeks to change, we need to peel back the onion to examine two salient provisions that currently make seeding ETFs qualify for non-recognition.

Here’s Morgan Freeman (fictitiously) explaining how it works. You must, of course, read it in his voice.