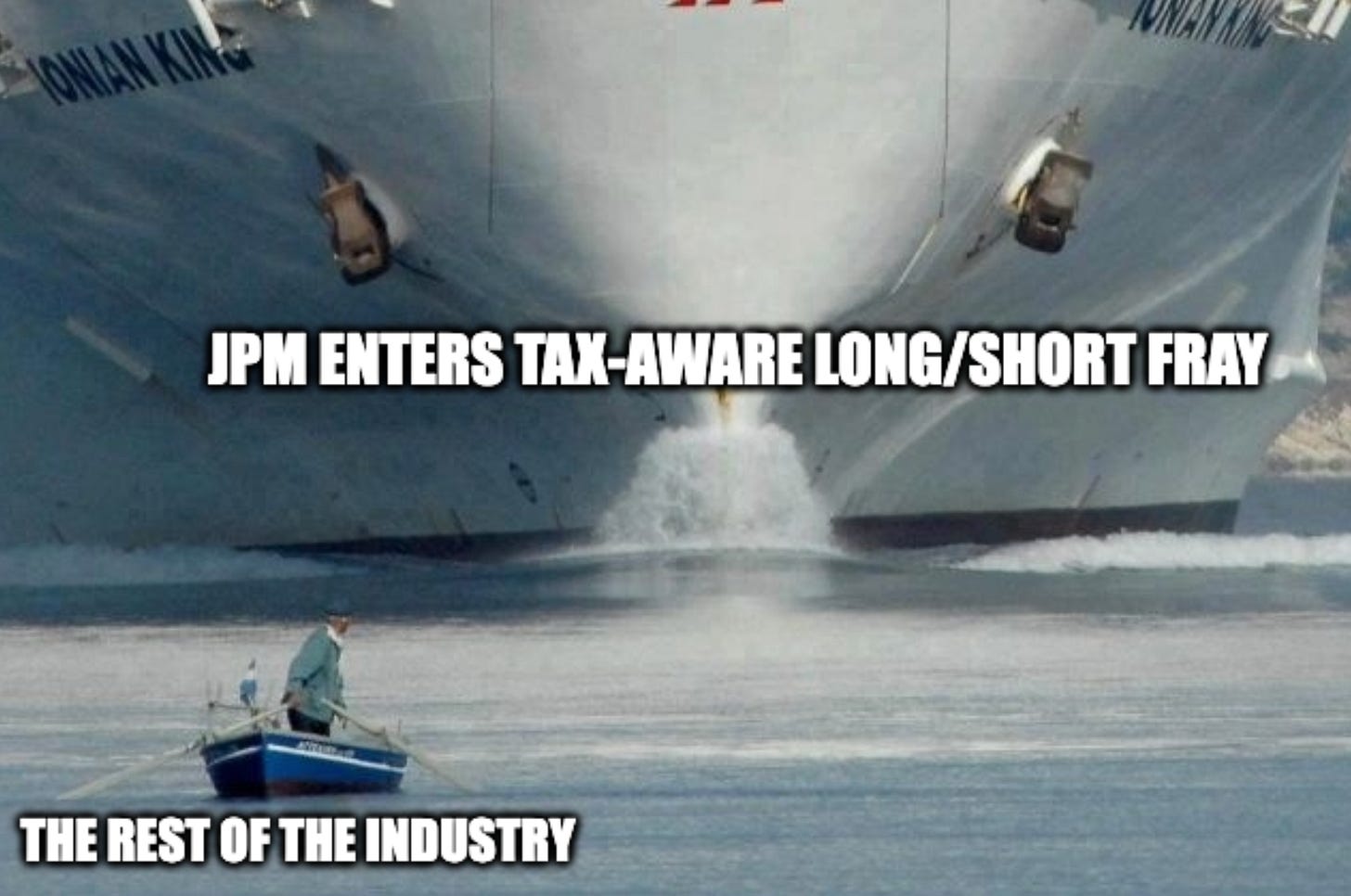

Jumbo portfolio manager adds tax-aware long/short private fund

See what I did there?

This article is educational content, not investment, tax, or legal advice. It is not an endorsement of any product or manager. Hire an adviser or tax attorney for personalized guidance.

Tax Alpha Bulletin Board

30% off annual subscriptions to Tax Alpha Insider Until Jan 2 2026

Support tax alpha memes, journalism, and analysis

Two-day taxable wealth conference

Seattle, WA - May 2026

Week of Jan 5, 2026: Sponsor prospectus released

Week of Jan 12, 2026: Registration opens

Jumbo portfolio manager adds tax-aware long/short private fund

Late on Tues (Dec 22, 2025) a few wealth manager pals emailed me a Bloomberg article.

Apparently, JPM is coming to market with a tax-aware long/short private fund, verbosely titled “J.P. Morgan Tax-Smart Disciplined Equity Long Short Strategy.”

This isn’t totally surprising. JPM has been at the long/short game for decades.

The JPMorgan U.S. Large Cap Core Plus Fund (JPLSX),1 a mutual fund, “[u]tilizes a long/short (130/30) strategy that combines an actively managed 100% long portfolio with an active equity long/short overlay portfolio,” launched in late 2005 and still has one of the original portfolio managers (yes… 20 years).

They’ve probably been testing the tax-aware long/short hedge fund behind the scenes for a while.

So, none of this is new, but in some ways it represents the mainstreaming of a complex strategy.

In this article…

Tax-aware hedge funds have been around for decades (a brief history)

Not all funds are created equal

JPM’s fund is the right play for JPM

What about separate accounts?

What about tax-aware separate account and hedge funds together?

What happened to Jones?

Long/short hedge funds have been around for decades

The first instance appears to be A. W. Jones & Co.’s hedge fund, which the mysterious Jones himself managed for 30-some odd years.