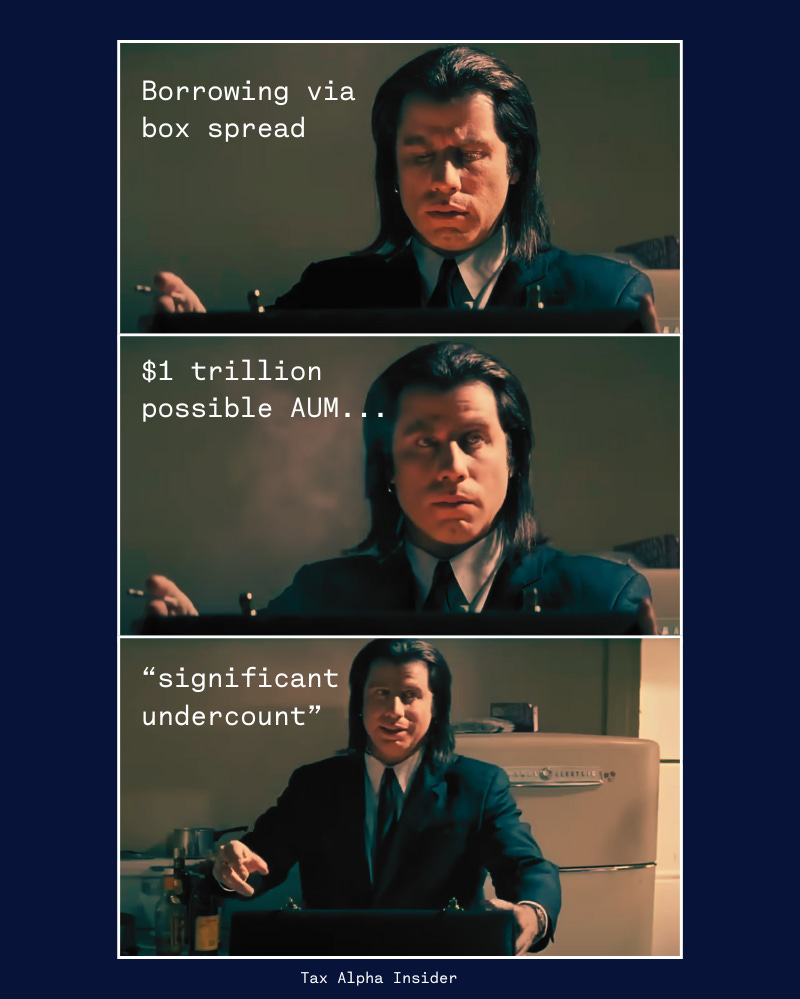

"Significant undercount" in $1 trillion box borrowing possible AUM

$2 trillion is closer. Far higher when including recent mortgages.

This article is educational content, not investment, tax, or legal advice. Hire an adviser or tax attorney for personalized guidance.

Basis Northwest: Two-day taxable wealth conference

Seattle, WA

May 2026

Details coming soon…

Also… Not Advice is live at 11 AM PT today.

I’ve been writing about borrowing via box spread for the past several months.

Every time I speak with a vendor, my estimate increases.

My first guess came from a vendor: $300 billion.

Then, I used Fed and FINRA data to argue for $1 trillion.

Now, I’m including some industry feedback and saying $2 trillion, and much more, is imaginable.

The value prop is lower borrowing rates, a tiny spread above the Treasury curve.

As a fiduciary product, pricing seems to range from 0.20%/yr to 0.95%/yr of notional.

I expect fiduciary pricing to come down dramatically because this isn’t that hard for a competent desk to execute.

0.00%/yr seems possible as a box loan could help the fiduciary win bigger business. Why not offer it as a loss-leader?

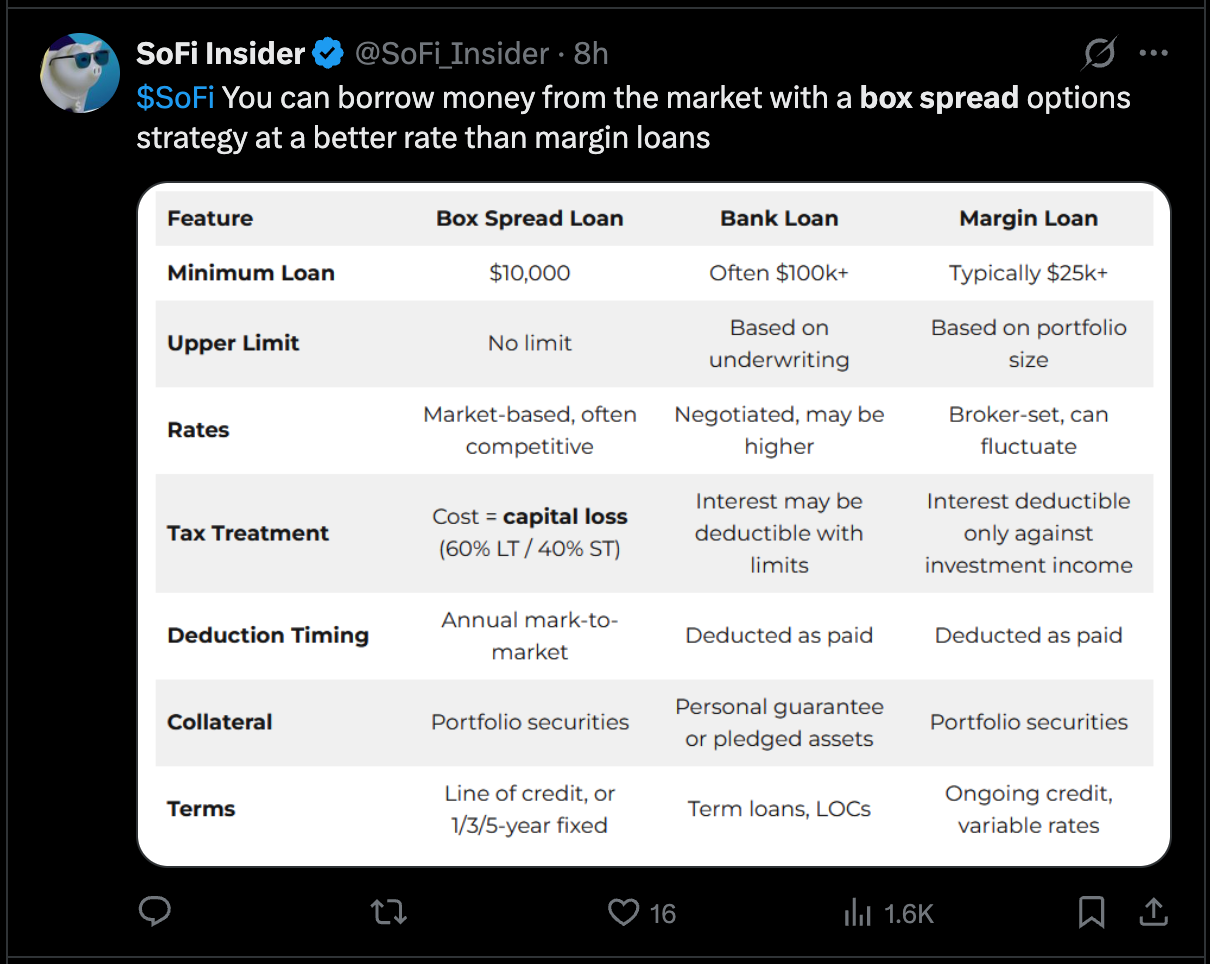

To this end, SoFi is getting in the game. I’m not aware of their pricing.

I just want to casually mention that SoFi Stadium is a real thing in the real world and seats 70,000 people.

Moreover, a startup recently reached out saying they’re getting out of the game and looking for an acquirer.

In any event, a breathless endorsement of box borrowing would be foolish, and my articles above try to call out unique risks and considerations, but I have much more to do.

To tease one area of research, we need to thoughtfully consider capital loss versus ordinary interest deduction from a standard margin loan or line of credit.

The framing in SoFi’s comparison table above is technically accurate, but “Interest deductible only against investment income” seems to downplay that “investment income” might be the deduction’s highest and best use, subject to the investor’s exact circumstances.

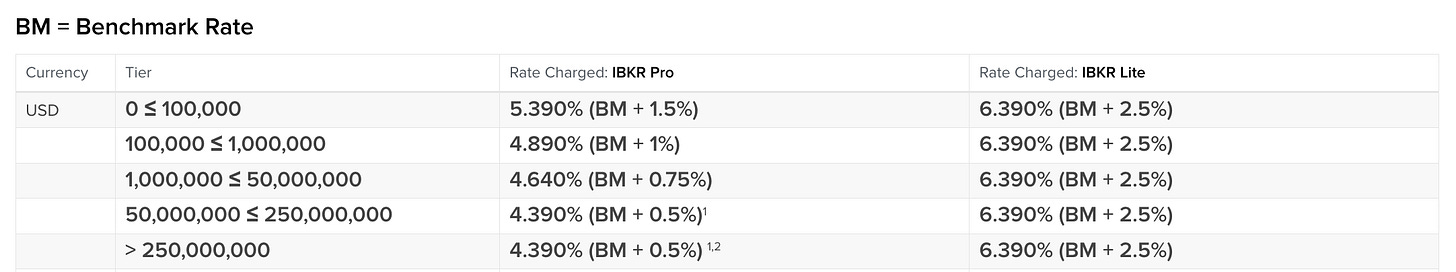

There are many tradeoffs to weigh, especially as lenders like Interactive Brokers offer competitive margin rates. Special thanks to Jonathan Treussard, Ph.D., for the discussion on this.

Getting to $2 trillion and beyond

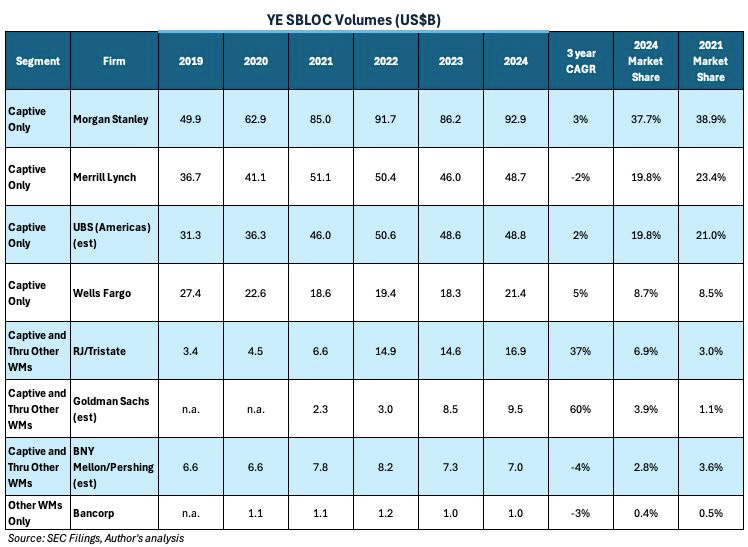

David Himmel, a wealth management industry analyst, suggested the Fed’s SBLOC estimates were “likely 100-150B off, based on tallying what the major lenders report in their 10ks.” Here’s his analysis.

It’s difficult to read, but the 2024 SBLOC total for these lenders is $246 billion, according to Himmel, >$100 billion above Fed estimates.

I update my tracker below using Himmel’s numbers and highlight recent Fed data showing that beyond $2 trillion possible AUM isn’t hard to imagine, given recent mortgage data and the possibility of refinancing partly using box spread borrowing.