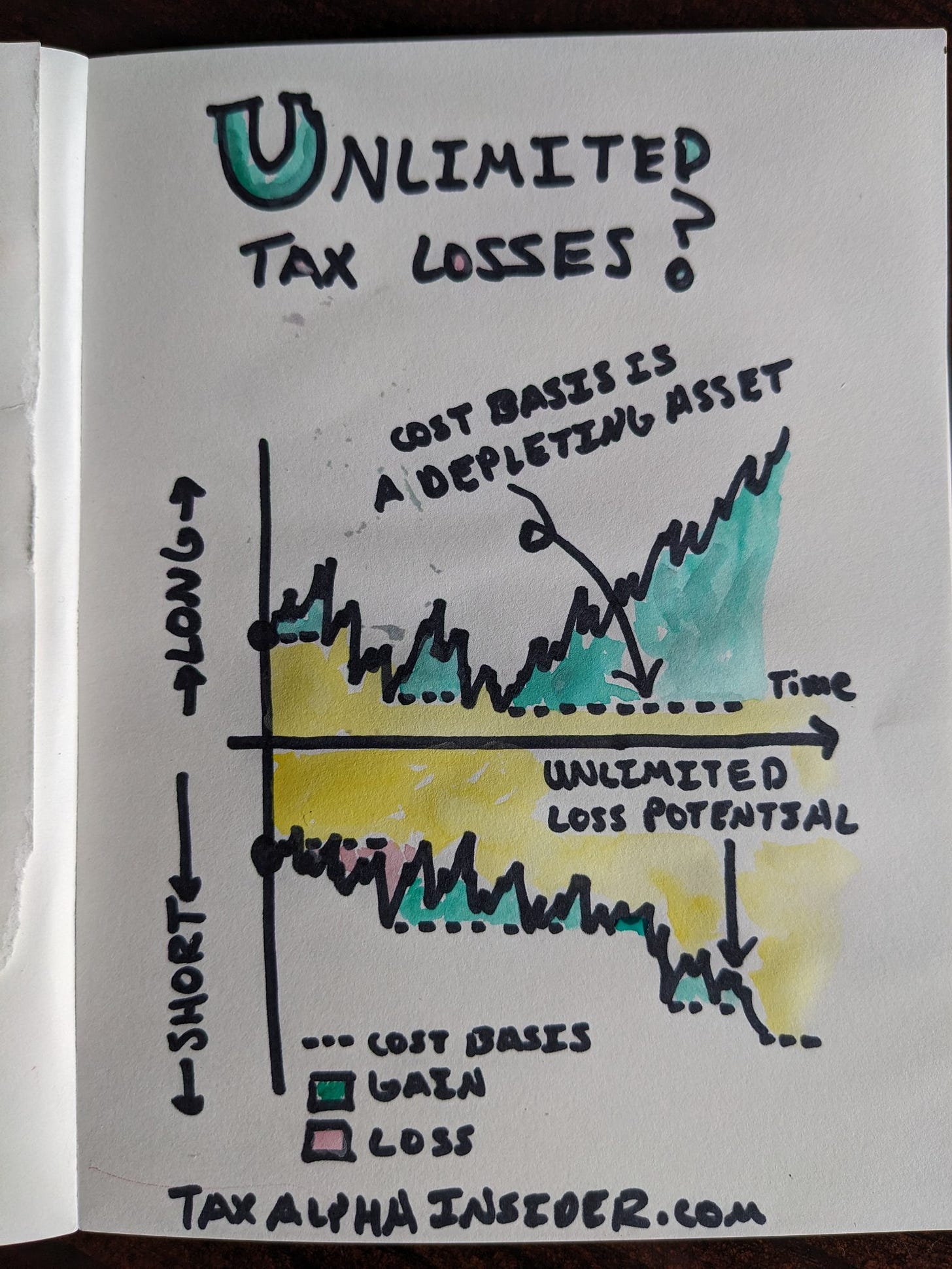

Tax-aware long/short doesn't lockup easily. Why?

Unlimited downside risk on the shorts is the key to understanding

Before jumping in… I’ll be a Future Proof in Huntington 9/7 - 9/91. See you there?

I’m still on vacation, which means lots of time with my 6-year-old and 3-year-old boys.

We listen to Mariners games on the radio (most unfortunately, as of late 🫠 🔱). We draw and paint a lot. It’s during these sessions that I doodle tax infographics like the one above.

Whe…