The big bad list of concentrated stock solutions

Sell it, wrap it, hedge it, cash it, gift it, swap it, hold - combine it

🎉 Basis Northwest is my taxable wealth conference. It’s in Seattle in 2026. Interested in attending, sponsoring, or speaking? Click this button.

Why is too much concentration a bad thing?

The short answer is uncompensated risk.

Another reason is the confusingly-named “sequence of return” risk, which I’m henceforth calling “It might be worth less when you need it” risk.

I can think of several categories of people who keep holding big stock positions they could easily sell in the public markets:

Practical (e.g., executives wanting control)

Emotional (e.g., grandpa gave me the shares)

Gambling (e.g., I know it’s dumb, but I like risk)

Experts (e.g., 17-year industry veteran)

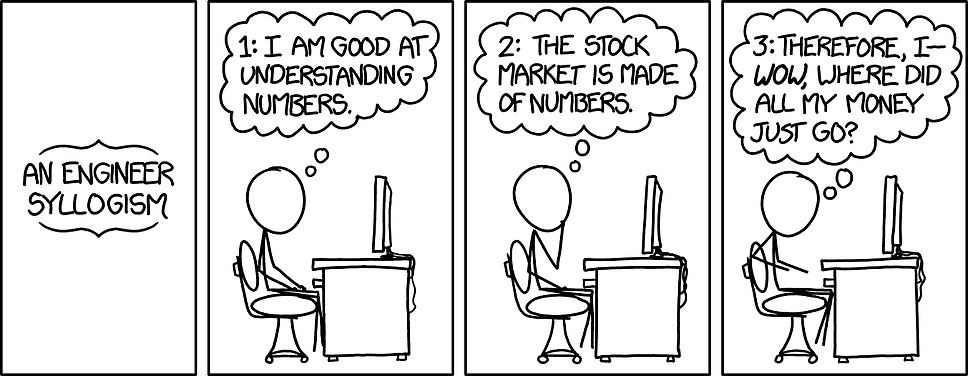

Dunning–Kruger (e.g., I did my own research 🤡)

Experts know their industry (though that doesn't make them expert investors).

DKs think they're experts, and are usually between steps (2) and (3) in this XKCD comic.

I think a lot of this overconfidence comes from the Enigma of Omaha.

Many people call Warren Buffett a hero and really adore his plainspoken annual conference and shareholder letters. I agree! They’re very good, except for one thing.

Warren Buffett has convinced generations of investors if they just roll up their sleeves and keep it simple (and own an insurance company that has access to float and leverage) they can also be successful stockpickers.

A while ago, I was doing a webinar about de-risking concentrated positions, and some dude essentially said, “That’s dumb.”

I was surveying a half-dozen or so single-stock solutions (full list below of 20+, including some oddballs you might like), and thought he meant the particular strategy I was illustrating.

Nope.

He meant the entire idea of diversifying was dumb.

This caught me off guard, so I mumbled something along the lines of “None of us are Jim Simons,” the legendary RenTech founder and billionaire, who toiled for 13 years in a strip mall after leaving academia.

I was wrong again.

He dropped in the following quotation from Warren Buffett, in real time, in front of a live audience1.

“You know, we think diversification is—as practiced generally—makes very little sense for anyone that knows what they’re doing”

I know that many people really, really enjoy picking stocks because Warren Buffett convinced them it’s possible.

It seems to me, however, that Warren Buffett has also recommended low-cost index funds countless times.

The Enigma of Omaha reveals the investor to themselves.

So, anyway, if you still have the “I can pick stocks like Buffett” bug to exorcise, do it… at your own risk.

I hope you kill it, because eventually you’ll want to unwind that chonky position housing all those unrealized capital gains, and a list like the one below might come in handy.

The rest of this blog updates my growing table of the latest and greatest single-stock diversification strategies with some simple points of comparison.