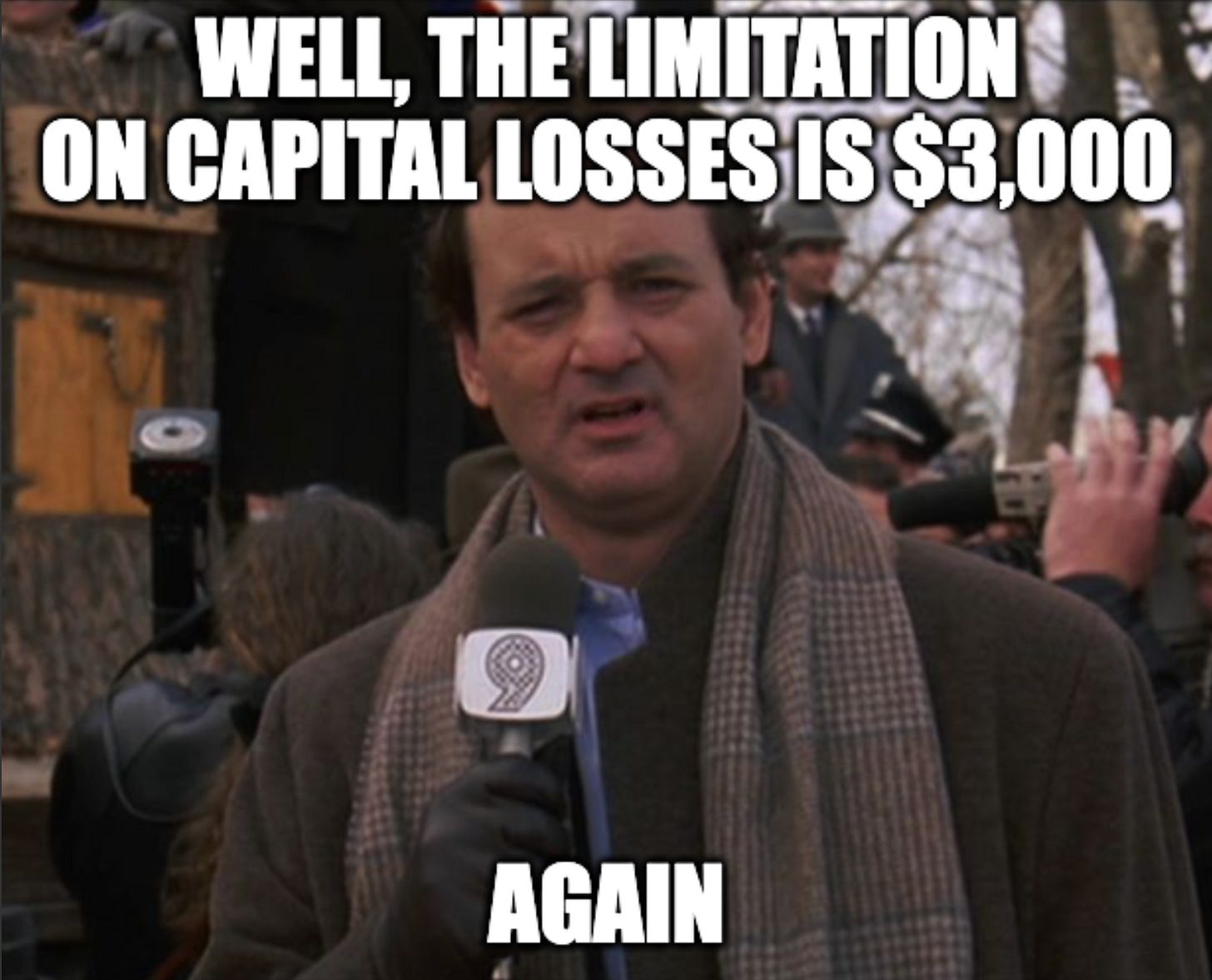

The many failed attempts to update the $3,000 limitation on capital loss deductions

Also... Generative AI isn't ready to touch money.

The 26 U.S. Code § 1211 $3,000 limitation on capital losses is mentioned in nearly every article, whitepaper, and journal article having anything to do with tax management1.

The limit is hardcoded into Form 1040 Schedule D.