Tax management = NPV (complexity & brain damage costs)

Alpha Architect is coming to Basis Northwest (May 28-29, 2026, Seattle, WA)

I'm happy to announce that Alpha Architect is a partner sponsor of Basis Northwest, and Ryan Kirlin (president) will be presenting.

Alpha Architect leads with education and a healthy dose of humility.

"NPV (complexity & brain damage costs)" sums it up nicely.

I've been a fan for years, and I'm glad they're joining us.

Basis Northwest registration is open.

Early bird tickets are limited and going fast.

The latest in tax alpha…

F/m adds a mutual fund share class to its ETF (you read that right)

Alpha Architect: Low-Cost Financing via Short Box Spreads: A Primer for Financial Advisors

Dimensional Fund Advisers: Going Beyond Indexing

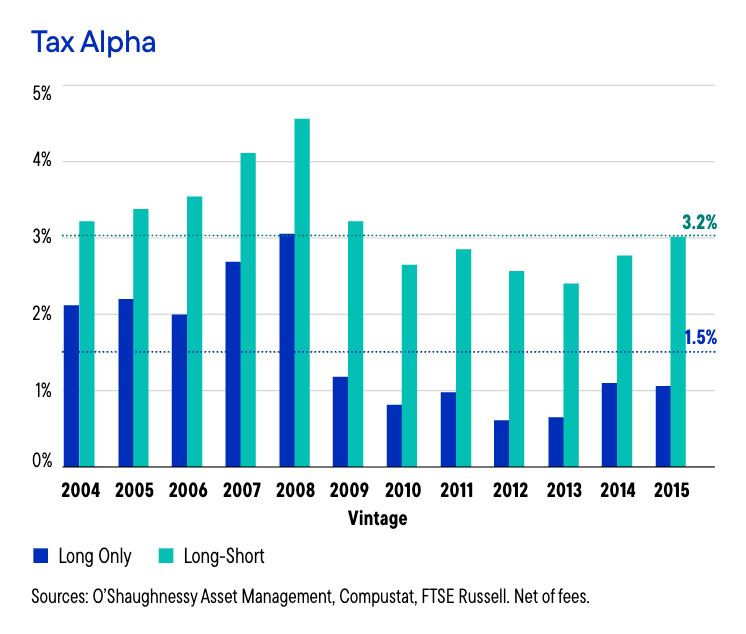

Canvas: Tax-aware long-short (A natural extension of custom indexing)

What’s going on here?

Recent coverage…

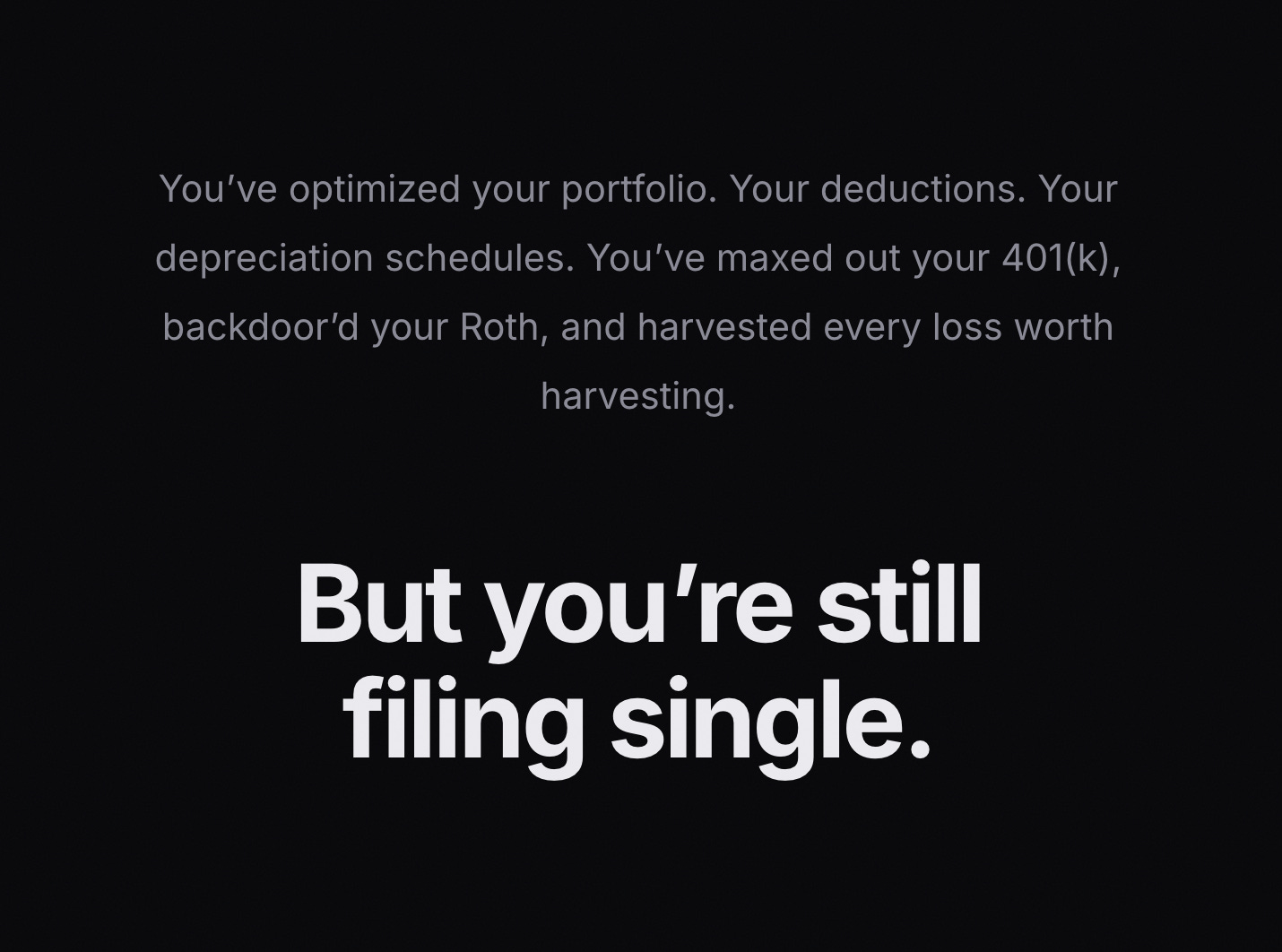

You ready for Valentine’s Day?

CarryForward Together is a new company that matches humans based on their… get this… tax status.

Think… Someone with gains meets someone with losses.

It’s crazy. It’s awkward.

It’s the future of tax planning.

Heads up: Tax Alpha Insider will slow down next week as my kids are out of school and we’re going to… Legoland.

Back to full speed on Monday, February 23.

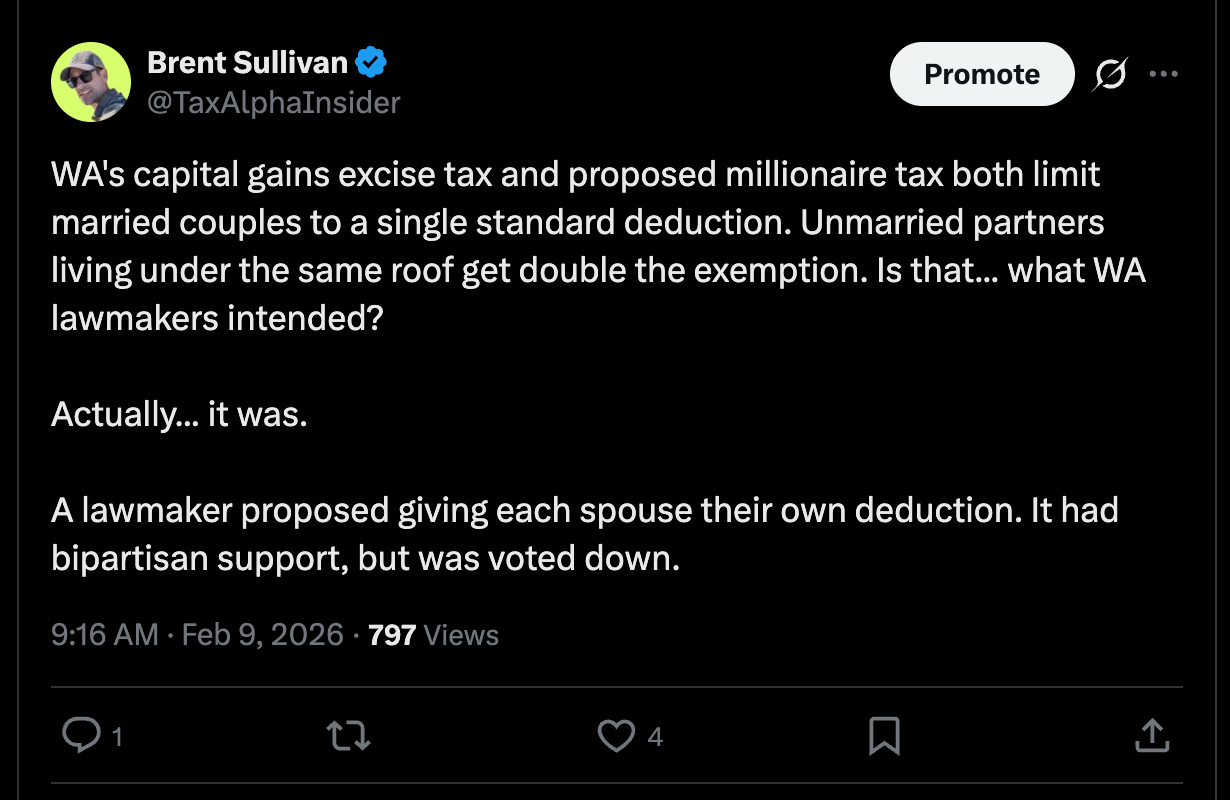

TGIF.

Related to your Washington state capital gains comment, there's a similar dynamic for the federal State and Local Tax deduction, where single households and joint households get the same SALT cap. In addition, getting married also means that the combined income gets applied to the same phase out amount. So there can be situations where two people can get married and the combined SALT deduction goes from $80,000 to $10,000. And because of that, I've told a lot of high income non-married couples to run the tax math before deciding to get married. (Important: I don't recommend making a decision on marriage based on tax deductions.)